“With more homes available for sale now, you have more options to choose from.”

There are more homes on the market right now than there have been in years – and that could be a game changer for you if you’re ready to buy. Let’s look at two reasons why.

You Have More Options To Choose From

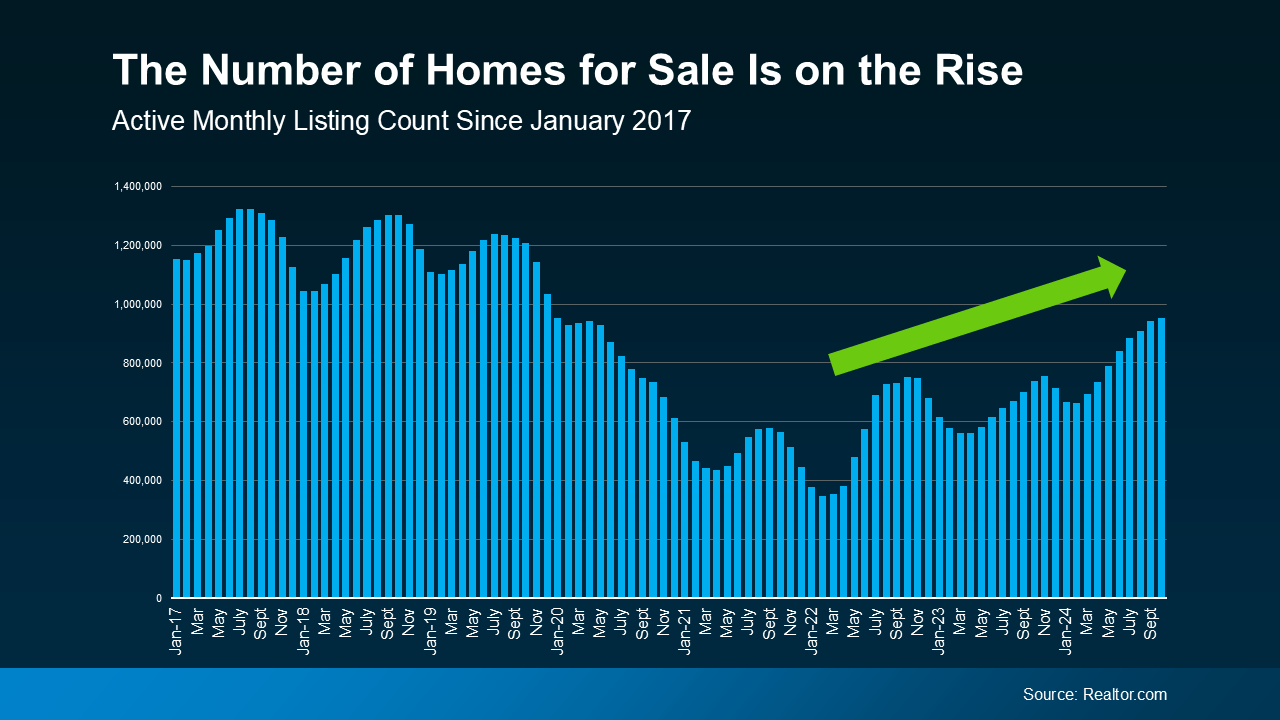

An article from Realtor.com helps explain just how much the number of homes for sale has gone up this year:

“There were 29.2% more homes actively for sale on a typical day in October compared with the same time in 2023, marking the twelfth consecutive month of annual inventory growth and the highest count since December 2019.”

And while the number of homes on the market still isn’t quite back to where it was in the years leading up to the pandemic, this is definitely an improvement (see graph below):

With more homes available for sale now, you have more options to choose from. As Hannah Jones, Senior Economic Research Analyst at Realtor.com, explains:

With more homes available for sale now, you have more options to choose from. As Hannah Jones, Senior Economic Research Analyst at Realtor.com, explains:

“Though still lower than pre-pandemic, burgeoning home supply means buyers have more options . . .”

That means you have a better chance of finding a house that meets your needs. It also means the buying process doesn’t have to feel quite as rushed, because more options on the market means you’ll likely face less competition from other buyers.

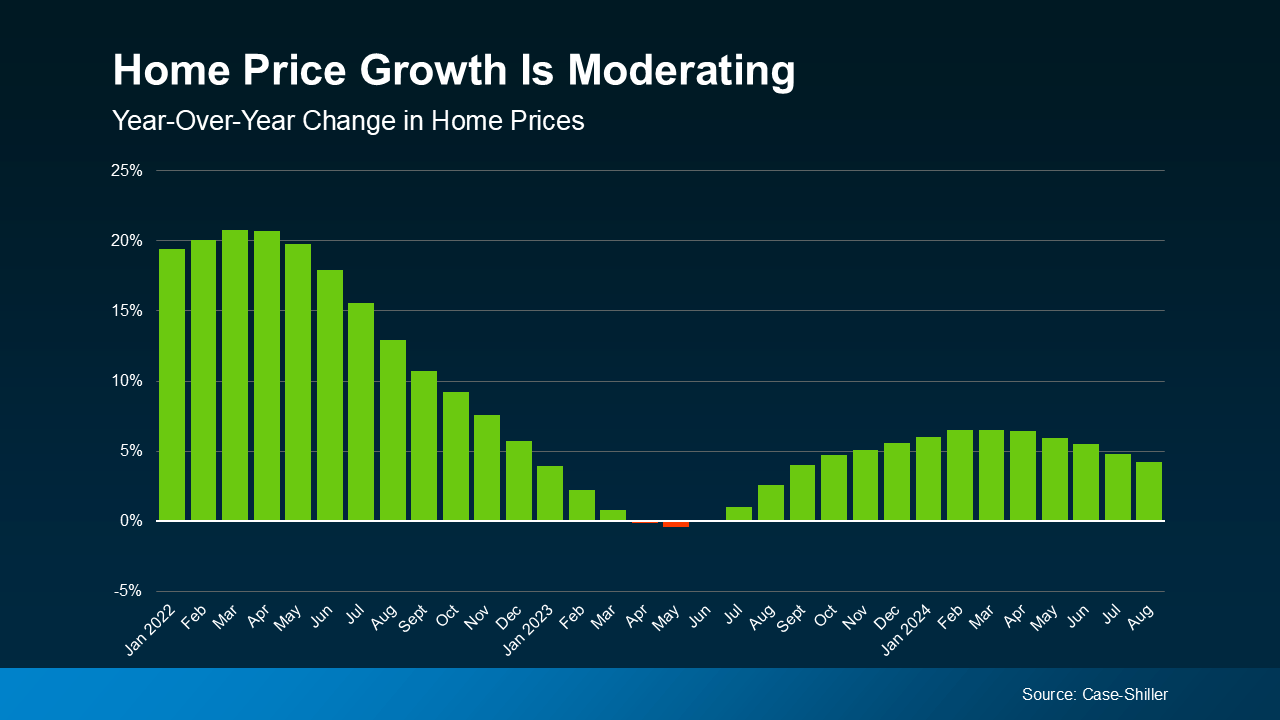

Home Price Growth Is Slowing

When there aren’t many homes for sale, buyers have to compete more fiercely for the ones that are available. That’s what happened a few years ago, and it’s what drove prices up so quickly.

But now, the increasing number of homes on the market is causing home price growth to slow down (see graph below):

In certain markets, the number of available homes has not only bounced back to normal, but has even surpassed pre-pandemic levels. In those areas, home price growth has slowed or stalled completely. As Lance Lambert, Co-Founder of ResiClub, explains:

In certain markets, the number of available homes has not only bounced back to normal, but has even surpassed pre-pandemic levels. In those areas, home price growth has slowed or stalled completely. As Lance Lambert, Co-Founder of ResiClub, explains:

“Generally speaking, housing markets where active inventory has returned to pre-pandemic 2019 levels have seen home price growth soften or even decline outright from their 2022 peak.”

Slower or stalled price growth could give you a better chance of finding something within your budget. As Dr. Anju Vajja, Deputy Director at the Federal Housing Finance Agency (FHFA), says:

“For the third consecutive month U.S. house prices showed little movement . . . relatively flat house prices may improve housing affordability.”

But remember, inventory levels and home prices are going to vary by market.

So, having a real estate agent who knows the local area can be a big advantage. They can help you understand the trends in your community, which can make a real difference in finding a home that fits your needs and budget.

Bottom Line

More housing options – and the slower home price growth they bring – can help you find and buy a home that works for your lifestyle and budget. So don’t hesitate to reach out if you want to talk about the growing number of choices you have right now.

To view original article, visit Keeping Current Matters.

The Benefits of Downsizing When You Retire

When you downsize your house, you often end up downsizing the bills that come with it, like energy costs, and maintenance requirements.

Why There Won’t Be a Recession That Tanks the Housing Market

The fundamentals of the economy, despite some hiccups, are doing pretty good.

What To Know About Credit Scores Before Buying a Home

Working with a trusted lender is the best way to get more information on how your credit score could factor into your home loan.

Why You Want an Agent’s Advice for Your Move

A real estate advisor can anticipate what could happen next and work with you to put together a solid plan.

Why Today’s Housing Supply Is a Sweet Spot for Sellers

The number of homes for sale and new listing activity continues to improve compared to last year.

The Truth About Down Payments

Unless specified by your loan type or lender, it’s typically not required to put 20% down. That means you could be closer to your homebuying dream than you realize.

.jpg )