“Now is a great time to make a move. Here’s why.”

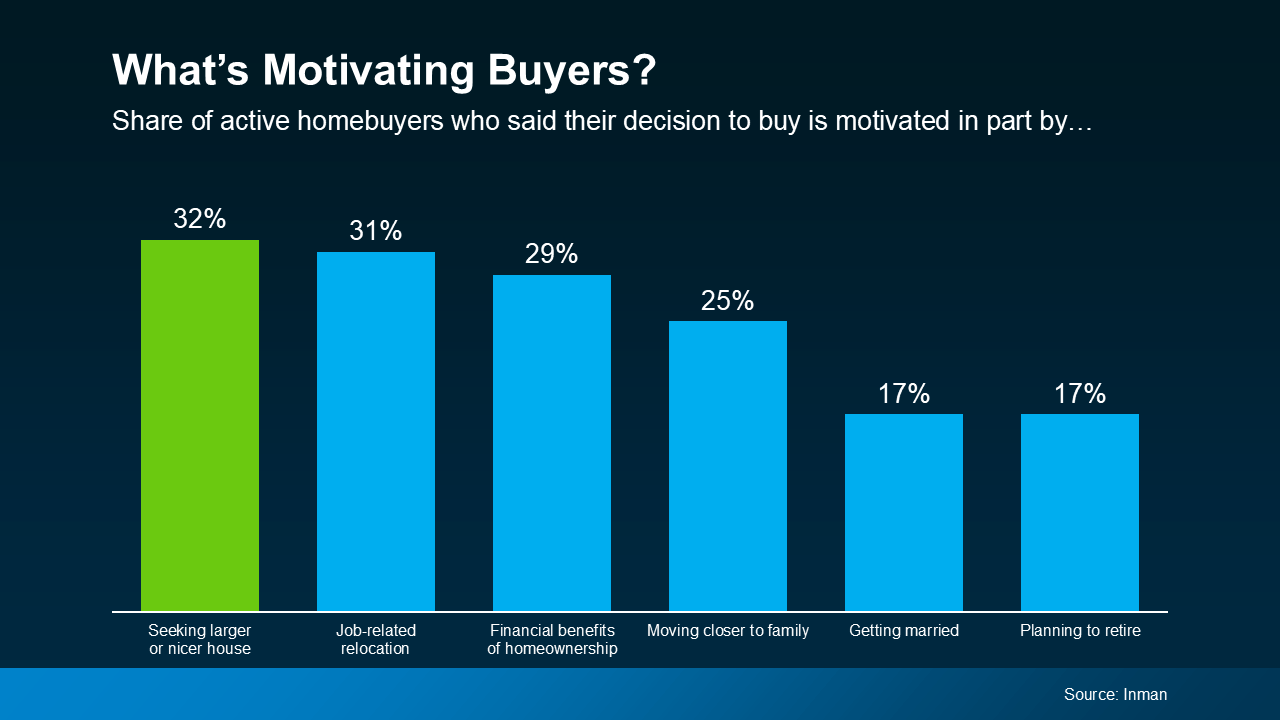

If you’ve been wanting to sell your house and move up to a bigger or nicer home, you’re not alone. A recent Inman survey reveals the top motivator for today’s homebuyers is the desire for more space or an upgraded home (see graph below):

But there’s also a good chance you, like many other people, have been holding off on that goal because of recent market challenges. It makes sense – when you’re planning an upgrade that could increase your monthly housing costs, affordability has a huge impact on when you make your move. But there’s good news: now’s actually a great time to make that move happen. Here’s why.

But there’s also a good chance you, like many other people, have been holding off on that goal because of recent market challenges. It makes sense – when you’re planning an upgrade that could increase your monthly housing costs, affordability has a huge impact on when you make your move. But there’s good news: now’s actually a great time to make that move happen. Here’s why.

You Have a Lot of Equity To Leverage

One of the key benefits in today’s market is the amount of equity you’ve likely built up in your current house over the years. Even with recent shifts in the housing market, national home prices have steadily grown, adding to the equity homeowners have today. Selma Hepp, Chief Economist at CoreLogic, explains it well:

“Persistent home price growth has continued to fuel home equity gains for existing homeowners who now average about $315,000 in equity and almost $129,000 more than at the onset of the pandemic.”

What does that mean for you? If you’ve been in your home for a few years, you’re probably sitting on a significant amount of equity. You can put that toward the down payment on your next home, helping keep the amount you borrow within a comfortable range.

This can make upgrading more achievable than you might think. If you’re curious how much you’ve built up over the years, ask your real estate agent for a professional equity assessment.

Mortgage Rates Have Fallen, Boosting Your Purchasing Power

And there’s another big reason why now’s a great time to make your move: mortgage rates are trending down. Lower rates can help make your future monthly payments more manageable, and they also increase your purchasing power. As Nadia Evangelou, Senior Economist and Director of Real Estate Research at the National Association of Realtors (NAR), points out:

“When mortgage rates fall, the interest portion of monthly payments decreases, which lowers the total payment. This makes it easier for more borrowers to . . . qualify for mortgages that may have been unaffordable at higher rates.”

That gives you more flexibility when shopping for homes and may allow you to afford a house at a price point that was previously out of reach. A trusted lender can work with you to figure out the best plan for your budget.

Bottom Line

If you’re ready to sell your current home and find the bigger, nicer home you’ve been dreaming of, don’t wait. Your equity, paired with lower mortgage rates, puts you in a great position to make that move today.

To make the best decisions and get the most out of your current market advantage, let’s connect so you have an expert guide through every step of the homebuying process.

To view original article, visit Keeping Current Matters.

Strategic Tips for Buying Your First Home

If you’re ready, willing, and able to buy your first home, here are some tips to help you turn your dream into a reality.

It’s Time To Prepare Your House for a Spring Listing

With the market gearing up for its busiest time of year, it’s important to make sure your house shines bright among the competition.

Bridging the Gaps on the Road to Homeownership

Homeownership is an important part of building household wealth that can be passed down to future generations.

Houses Are Still Selling Fast

Homes are selling faster than the norm for this time of year – and your house may sell quickly too. Are you thinking about selling your house? Give us a call!

Why Having Your Own Agent Matters When Buying a New Construction Home

Having a trusted agent on your side can make a big difference when it comes to buying a newly constructed home!

Don’t Wait Until Spring To Sell Your House

While spring is usually the peak homebuying season, you don’t actually need to wait until spring to sell.

.jpg )