“When you own your home, your housing expense (the mortgage payment) comes back to you in the form of equity in your home.”

One of the benefits of homeownership is that it is a “forced savings plan.” Here’s how it works: You make a mortgage payment each month. Part of that payment is applied to the principal balance of your mortgage. Each month you owe less on the home. The difference between the value of the home and what you owe is called equity.

If your home has appreciated since the time you purchased it, that increase in value also raises your equity. Over time, the equity in your home could be substantial. Recently, CoreLogic revealed that the average homeowner gained more than $65,000 in equity over the last 5 years.

Unlike last decade, homeowners are no longer foolishly tapping into that equity. In 2006-2008, many owners used their homes like an ATM by pulling equity out to purchase new cars, jet skis, or lavish vacations. They were pulling out cash (equity) from an appreciating asset, and then spending it on rapidly depreciating items. That is not happening anymore.

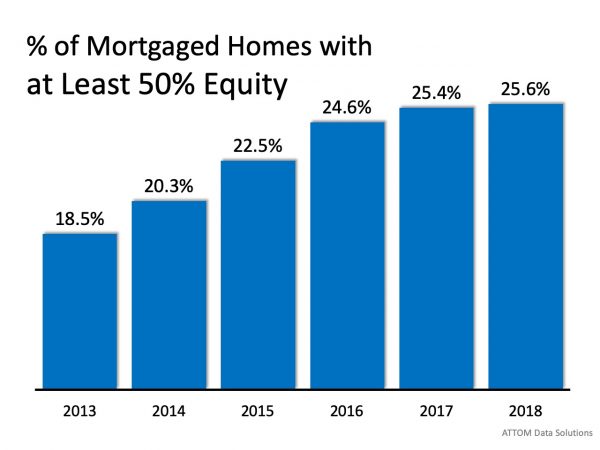

Over 50% of Homes Have at Least 50% Equity

The number of homeowners that currently have at least 50% equity in their home is astonishing. According to the Urban Institute, 37.1% of all homes in the country are mortgage-free. In a home equity study, ATTOM Data Solutions revealed that of the 62.9% of homes with a mortgage, 25.6% have at least 50% equity. That number has been increasing over the last five years: By doing a little math, we can see that 53.2% of all homes in this country have at least 50% equity right now. Of all homes, 37.1% are mortgage-free and an additional 16.1% with a mortgage have at least 50% equity.

By doing a little math, we can see that 53.2% of all homes in this country have at least 50% equity right now. Of all homes, 37.1% are mortgage-free and an additional 16.1% with a mortgage have at least 50% equity.

Bottom Line

Homeownership is different than renting. When you own, your housing expense (the mortgage payment) comes back to you in the form of equity in your home. That doesn’t happen with your rent payment. Your rent helps build your landlord’s equity instead.

To view original article, visit Keeping Current Matters.

What You Can Do When Mortgage Rates Are a Moving Target

You can get the best rate possible in today’s market by controlling your credit score, loan type, and loan term..

Are You Saving Up to Buy a Home? Your Tax Refund Can Help

If you’re getting a tax refund this year, you can use it to help you pay for some of the upfront costs that come with buying a home.

Don’t Miss This Prime Spring Window To Sell Your House

By targeting late spring, sellers can get their home listed when the most shoppers are looking.

4 Ways to Make an Offer That Stands Out This Spring

If you’re serious about landing a home you’ll love, you need a smart strategy that includes a working with a great agent.

Pre-Approval Isn’t Commitment – It’s Clarity

Pre-approval isn’t about jumping the gun or rushing your timeline. It’s about making sure you’re ready when it’s go-time.

Why You Don’t Want To Skip Your Home Inspection

Skipping a home inspection is a risk that could cost you a lot more than just time.

.jpg )