“When you own your home, your housing expense (the mortgage payment) comes back to you in the form of equity in your home.”

One of the benefits of homeownership is that it is a “forced savings plan.” Here’s how it works: You make a mortgage payment each month. Part of that payment is applied to the principal balance of your mortgage. Each month you owe less on the home. The difference between the value of the home and what you owe is called equity.

If your home has appreciated since the time you purchased it, that increase in value also raises your equity. Over time, the equity in your home could be substantial. Recently, CoreLogic revealed that the average homeowner gained more than $65,000 in equity over the last 5 years.

Unlike last decade, homeowners are no longer foolishly tapping into that equity. In 2006-2008, many owners used their homes like an ATM by pulling equity out to purchase new cars, jet skis, or lavish vacations. They were pulling out cash (equity) from an appreciating asset, and then spending it on rapidly depreciating items. That is not happening anymore.

Over 50% of Homes Have at Least 50% Equity

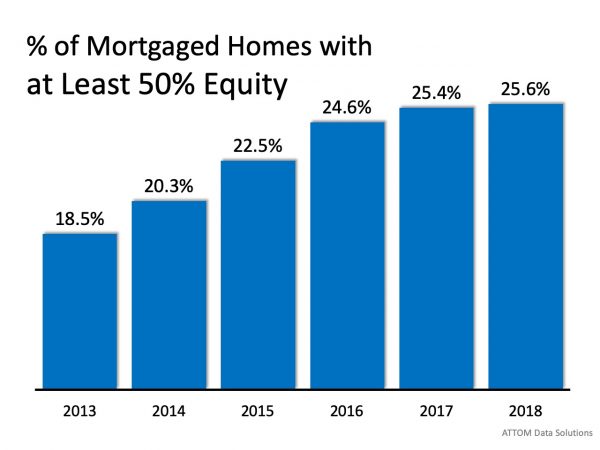

The number of homeowners that currently have at least 50% equity in their home is astonishing. According to the Urban Institute, 37.1% of all homes in the country are mortgage-free. In a home equity study, ATTOM Data Solutions revealed that of the 62.9% of homes with a mortgage, 25.6% have at least 50% equity. That number has been increasing over the last five years: By doing a little math, we can see that 53.2% of all homes in this country have at least 50% equity right now. Of all homes, 37.1% are mortgage-free and an additional 16.1% with a mortgage have at least 50% equity.

By doing a little math, we can see that 53.2% of all homes in this country have at least 50% equity right now. Of all homes, 37.1% are mortgage-free and an additional 16.1% with a mortgage have at least 50% equity.

Bottom Line

Homeownership is different than renting. When you own, your housing expense (the mortgage payment) comes back to you in the form of equity in your home. That doesn’t happen with your rent payment. Your rent helps build your landlord’s equity instead.

To view original article, visit Keeping Current Matters.

More Homes, Slower Price Growth – What It Means for You as a Buyer

Having a real estate agent who knows the local area can be a big advantage when you start the buying process.

Renting vs. Buying: The Net Worth Gap You Need To See

If you’re on the fence, it may be helpful to speak with a local real estate agent. They can help you weigh your options.

What’s Motivating Homeowners To Move Right Now

Selling your home isn’t just about market conditions or mortgage rates—it’s also about making the best decision for your lifestyle and future.

Expect the Unexpected: Anticipating Volatility in Today’s Housing Market

Understanding what’s happening will help you make the right decisions, whether that’s buying or selling.

The Majority of Veterans Are Unaware of a Key VA Loan Benefit

VA home loans are designed to make homeownership a reality for those who have served our country.

Is a Fixer Upper Right for You?

The perfect home is the one you perfect after buying it. With careful planning, budgeting, and a little bit of vision, you can turn a house that needs some love into your perfect home.

.jpg )