“Mortgage rates are higher and home prices are rising, yet people are still moving.“

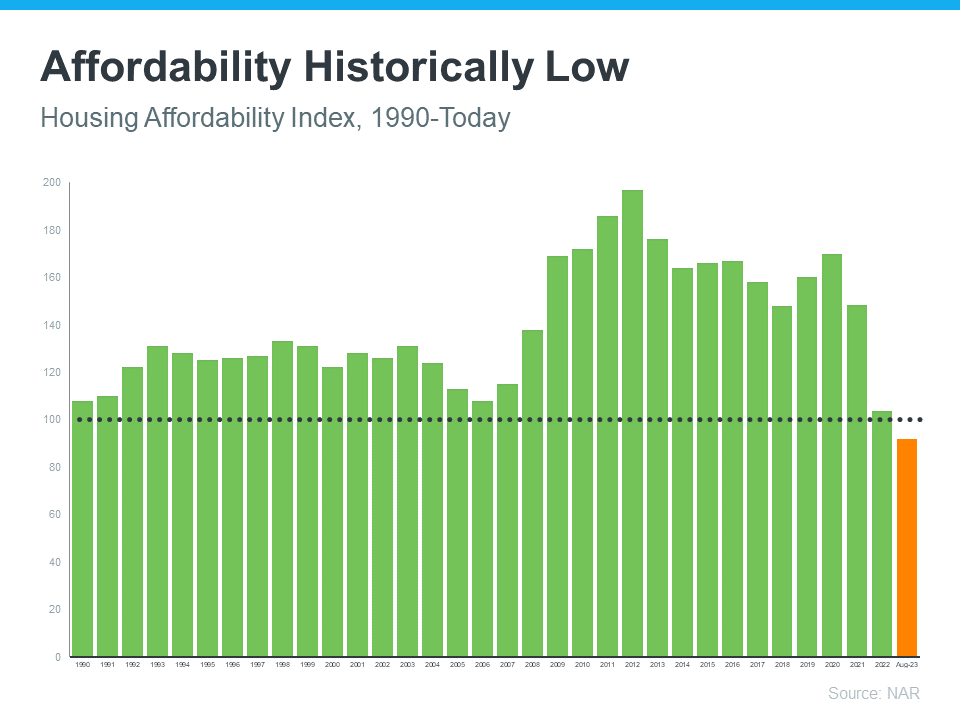

If you’re thinking about buying or selling a home, you might have heard that it’s tough right now because mortgage rates are higher than they’ve been over the past few years, and home prices are rising. That much is true. Take a look at the graph below. It breaks down how the current affordability situation stacks up to recent years.

The National Association of Realtors (NAR) explains how to read the values on the graph:

“To interpret the indices, a value of 100 means that a family with the median income has exactly enough income to qualify for a mortgage on a median-priced home.”

The black dotted line represents that 100 value on the index. Essentially, the higher the bar, the more affordable homes are. As you can see, the orange bar for today shows higher mortgage rates and home prices have created a clear challenge. But, while affordability is definitely tighter right now, that doesn’t mean the housing market is at a standstill.

According to NAR, based on the pace of sales right now, just under 4 million homes will sell this year. With some simple math, let’s break down what that really means for you:

- 3.96 million homes divided by 365 days in a year = 10,849 houses sell each day

- 10,849 divided by 24 hours in a day = 452 houses sell per hour

- 452 divided by 60 minutes in an hour = about 8 houses sell each minute

So, on average, over 10,000 homes sell each day in this country. Whether you’re a buyer or a seller, this goes to show there are still ways to make your move possible, even at a time when affordability is tight.

An Agent Can Help You Make Your Move a Reality

You may be wondering how other homebuyers and sellers are making this happen now. One of the biggest game-changers in today’s market is working with a trusted local real estate agent. Great agents are helping other people just like you navigate today’s market and the current affordability situation, and their insight is invaluable right now.

True professionals will be able to offer advice tailored to your specific wants, needs, budget, and more. Not to mention, they’ll also be able to draw on their experience of what’s working for other buyers and sellers right now. This could mean broadening your search, if needed, to include other housing types like condos, townhouses, or neighborhoods a bit further out to help offset some of the affordability challenges today.

Bottom Line

You might think there aren’t many people buying or selling homes right now since affordability is tighter than it’s been in quite some time, but that’s not the case. It’s true that buying a home has become more expensive over the past couple of years, but people are still moving.

If you’re hoping to buy or sell a home today, know that other people are still making their goals a reality – and that’s happening in large part because of the help and advice of skilled local real estate agents. Want to talk to a trusted professional about your own move? Let’s connect.

To view original article, visit Keeping Current Matters.

3 Graphs To Show This Isn’t a Housing Bubble

It’s only natural for concerns to creep in that it could be a repeat of what took place in 2008. Today’s market is nothing like that.

Why Are People Moving Today?

While mortgage rates are higher than they were at the start of the year and home prices are rising, you shouldn’t put your plans on hold based solely on market factors.

A Window of Opportunity for Homebuyers

The housing market is still strong; it’s just easing off from the unsustainable frenzy it saw during the height of the pandemic.

What’s Causing Ongoing Home Price Appreciation?

Experts forecast ongoing home price appreciation thanks to the lingering imbalance of supply and demand.

Think Home Prices Are Going To Fall? Think Again

If you’re planning to buy a home, you shouldn’t wait for home prices to drop to make your purchase.

Why Pre-Approval Is a Game Changer for Homebuyers

Pre-approval from a lender helps you understand your true price range and how much money you can borrow for your loan.

.jpg )