“Data shows more homeowners are getting used to where rates are and thinking it may be time to move.”

When mortgage rates spiked up over the last few years, some homeowners put their plans to move on pause. Maybe you did too because you didn’t want to sell and take on a higher mortgage rate for your next home. But is that still the right strategy for you?

In today’s market, data shows more homeowners are getting used to where rates are and thinking it may be time to move. As Mark Zandi, Chief Economist at Moody’s Analytics, explains:

“Listings are up a bit as life events and job changes are putting increasing pressure on locked-in homeowners to sell their homes. Homeowners may also be slowly coming to the realization that mortgage rates aren’t going back anywhere near the rate on their existing mortgage.”

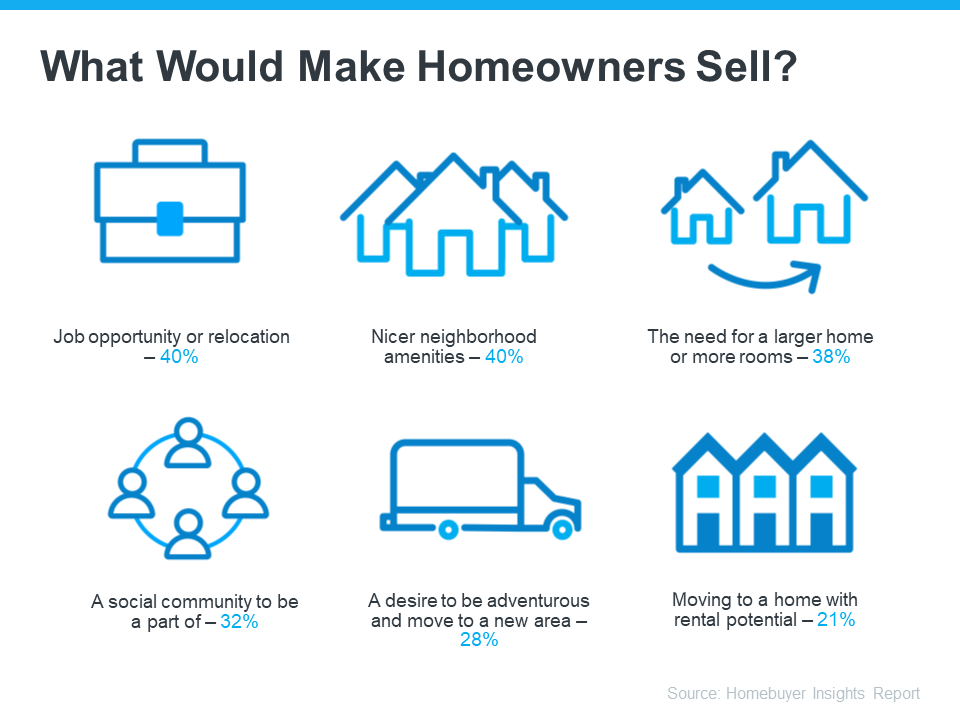

A recent study from Bank of America sheds light on some of the things homeowners say would make them sell, even with rates where they are right now (see visual below):

What Would Motivate You To Move?

Now that you know why other people would move, take a minute to think about what would make a move worth it for you. Is it time to take a chance and go for your dream job, even though it’s not local? Are you looking for a neighborhood that has more to offer and a close-knit sense of community? Maybe you just need more space, you’re looking for your next great adventure, or you want a house that opens up rental opportunities to pad your income.

And here’s something else to consider. Mortgage rates are still expected to go down over the course of the year. And once that happens, there’s going to be a big rush of buyers jumping back into the market. While you could delay your plans until rates drop, you’ll only have more competition with those buyers if you do.

So, does that mean it’s worth it to move now, even with rates where they are? The answer is: that it depends.

You’ll want to consider today’s mortgage rates, where they’re expected to go from here, and what would prompt you to want to make a change as you decide on your next steps. An expert can help with that.

Bottom Line

Other homeowners are getting used to rates and deciding to move. Let’s chat to go over what matters most to you and if it’s time for you to jump back into the market too.

To view original article, visit Keeping Current Matters.

Today’s Biggest Housing Market Myths

If you have questions about what you’re hearing or reading, let’s connect. You deserve to have someone you can trust to get the facts and sort out the misconceptions.

How To Choose a Great Local Real Estate Agent

The right agent should be someone you trust to guide you through one of the most significant transactions of your life.

How Mortgage Rate Changes Impact Your Homebuying Power

Real estate agents have the expertise to help you understand what’s happening and what it means for you.

What Credit Score Do You Really Need to Buy a House?

While many lenders use credit scores like FICO Scores to help them make lending decisions, each lender has its own strategy.

Is Affordability Starting to Improve?

While affordability is still tight, there are signs it’s getting a little better and might keep improving throughout the rest of the year. Here’s a look at the latest data.

Are There More Homes for Sale Where You Live?

Increased housing supply spells good news for consumers who want to see more properties before making purchasing decisions.

.jpg )