“According to Freddie Mac, rates are projected to increase to 3.9% by this time next year.”

Some Highlights:

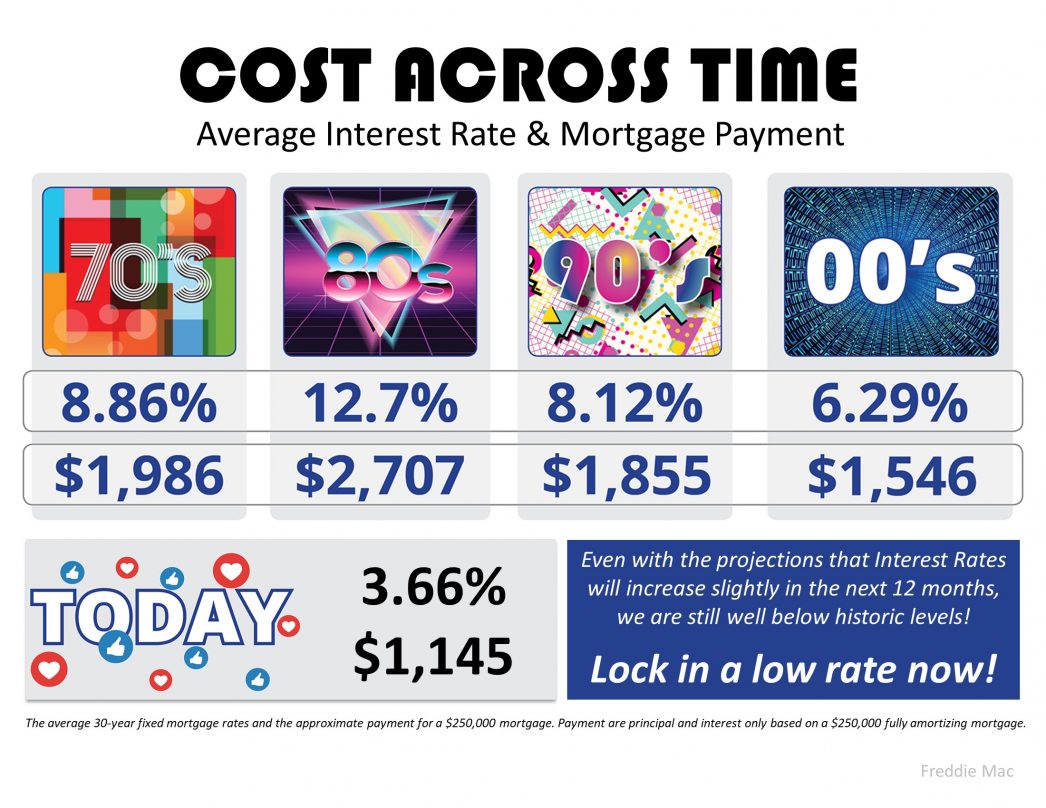

- With interest rates around 3.66%, now is a great time to look back at where they’ve been over the past few decades. Comparatively, they’re pretty low!

- According to Freddie Mac, rates are projected to increase to 3.9% by this time next year.

- The impact your interest rate has on your monthly mortgage payment is significant. An increase of just $20 dollars in your monthly payment can add up to $240 per year and $7,200 over the life of your loan.

- Maybe it’s time to lock in now, while rates are still historically low.

To view original article, visit Keeping Current Matters.

Houses Are Still Selling Fast

Homes are selling faster than the norm for this time of year – and your house may sell quickly too. Are you thinking about selling your house? Give us a call!

Why Having Your Own Agent Matters When Buying a New Construction Home

Having a trusted agent on your side can make a big difference when it comes to buying a newly constructed home!

Don’t Wait Until Spring To Sell Your House

While spring is usually the peak homebuying season, you don’t actually need to wait until spring to sell.

2 of the Factors That Impact Mortgage Rates

If you’re looking to buy a home, you’ve probably been paying close attention to mortgage rates. Ever wonder why they change?

Will a Silver Tsunami Change the 2024 Housing Market?

The thought is that as baby boomers grow older, a significant number will start downsizing their homes, but will it happen this year?

Are More Homeowners Selling as Mortgage Rates Come Down?

While there isn’t going to suddenly be an influx of options for your home search, it does mean more sellers may be deciding to list.

.jpg )