“According to Freddie Mac, rates are projected to increase to 3.9% by this time next year.”

Some Highlights:

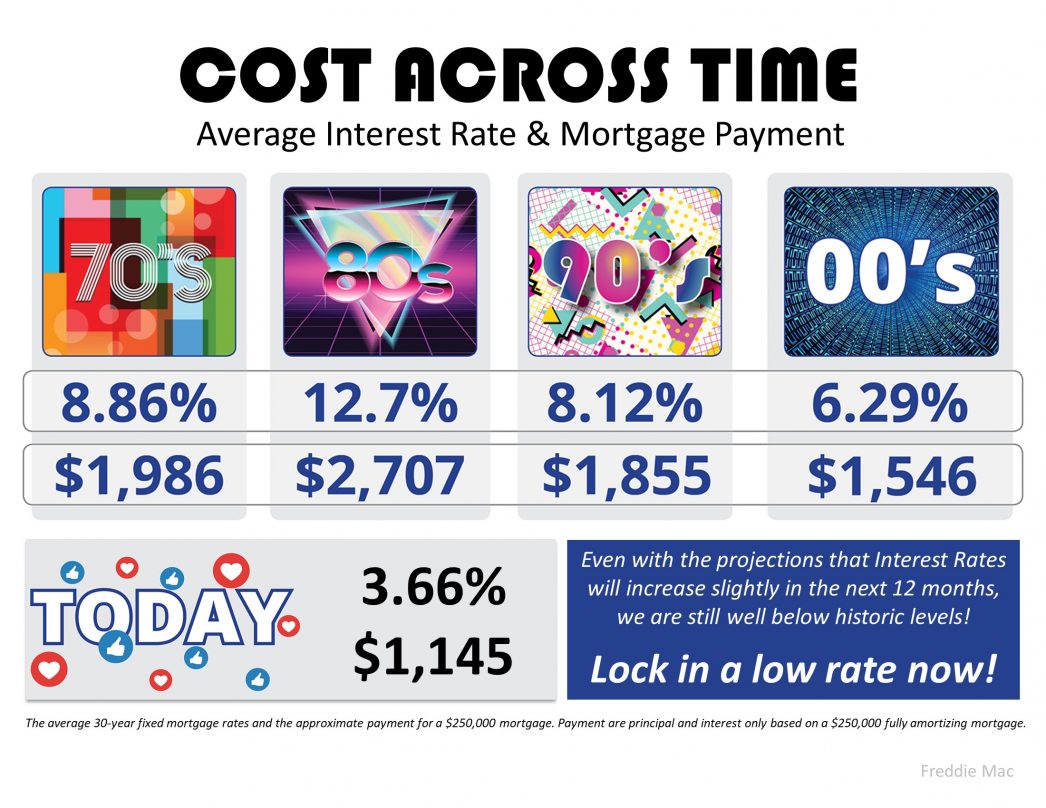

- With interest rates around 3.66%, now is a great time to look back at where they’ve been over the past few decades. Comparatively, they’re pretty low!

- According to Freddie Mac, rates are projected to increase to 3.9% by this time next year.

- The impact your interest rate has on your monthly mortgage payment is significant. An increase of just $20 dollars in your monthly payment can add up to $240 per year and $7,200 over the life of your loan.

- Maybe it’s time to lock in now, while rates are still historically low.

To view original article, visit Keeping Current Matters.

Experts Project Home Prices Will Increase in 2024

Expected home price appreciation also means if you’re ready, willing, and able to buy, waiting just means it will cost more later.

3 Must-Do’s When Selling Your House in 2024

A real estate professional can help you with expertise on getting your house ready to sell.

3 Key Factors Affecting Home Affordability

Home affordability depends on three things: mortgage rates, home prices, and wages and they’re moving in a positive direction for buyers.

Why You May Want To Seriously Consider a Newly Built Home

Newly built homes are becoming an increasingly significant part of today’s housing inventory.

Homeownership Is Still at the Heart of the American Dream

Buying a home is a powerful decision, and it remains at the heart of the American Dream.

Why Pre-Approval Is Your Homebuying Game Changer

If you’re thinking about buying a home, pre-approval is a crucial part of the process you definitely don’t want to skip.

.jpg )