“According to Freddie Mac, rates are projected to increase to 3.9% by this time next year.”

Some Highlights:

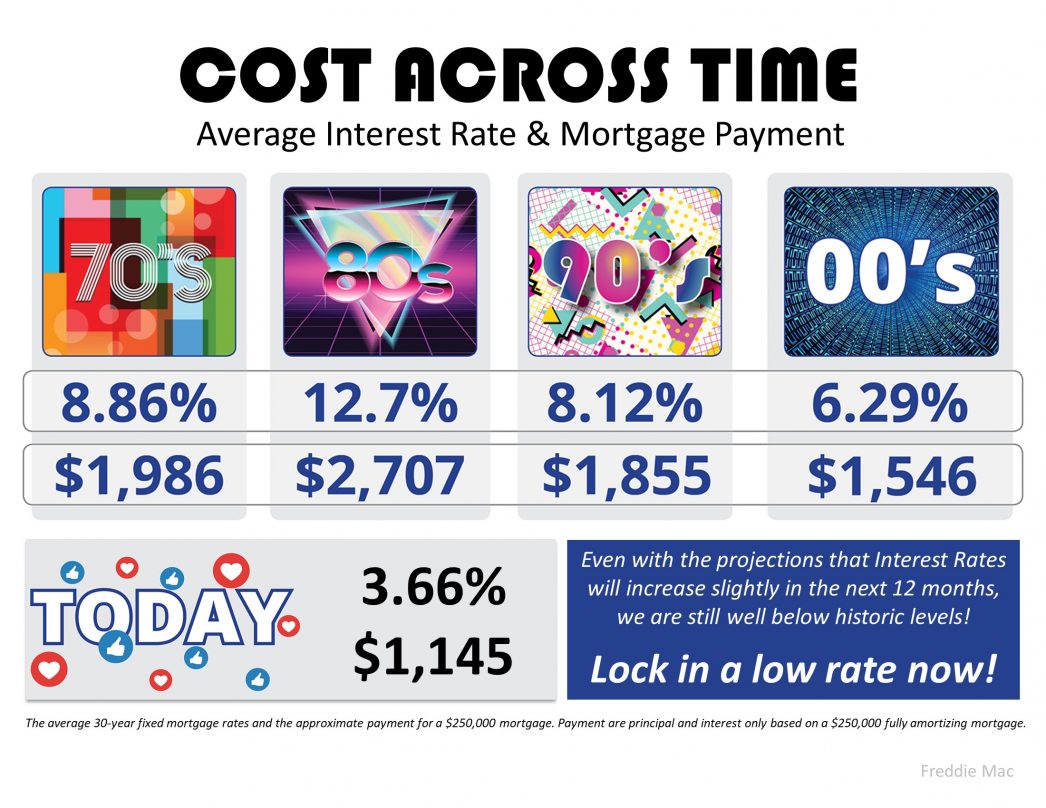

- With interest rates around 3.66%, now is a great time to look back at where they’ve been over the past few decades. Comparatively, they’re pretty low!

- According to Freddie Mac, rates are projected to increase to 3.9% by this time next year.

- The impact your interest rate has on your monthly mortgage payment is significant. An increase of just $20 dollars in your monthly payment can add up to $240 per year and $7,200 over the life of your loan.

- Maybe it’s time to lock in now, while rates are still historically low.

To view original article, visit Keeping Current Matters.

There’s Only Half the Inventory of a Normal Housing Market Today

If you want to list your house, know that there’s only about half the inventory there’d usually be in a more normal year.

Four Ways You Can Use Your Home Equity

Understanding how home equity works, and how to leverage it, is important for any homeowner.

Sellers: Don’t Let These Two Things Hold You Back

If fear you won’t be able to find your next home is the primary thing holding you back, remember to consider all your options.

Pricing Your House Right Still Matters Today

Pricing your house fairly based on market conditions increases the chance you’ll have more buyers who are interested in purchasing it.

Homebuyers Are Still More Active Than Usual

Buyer demand hasn’t disappeared, and in many places remains strong largely due to the shortage of homes on the market.

Don’t Fall for the Next Shocking Headlines About Home Prices

In the coming months, you’re going to see even more headlines that either get what’s happening with home prices wrong or are misleading.

.jpg )