“According to Freddie Mac, rates are projected to increase to 3.9% by this time next year.”

Some Highlights:

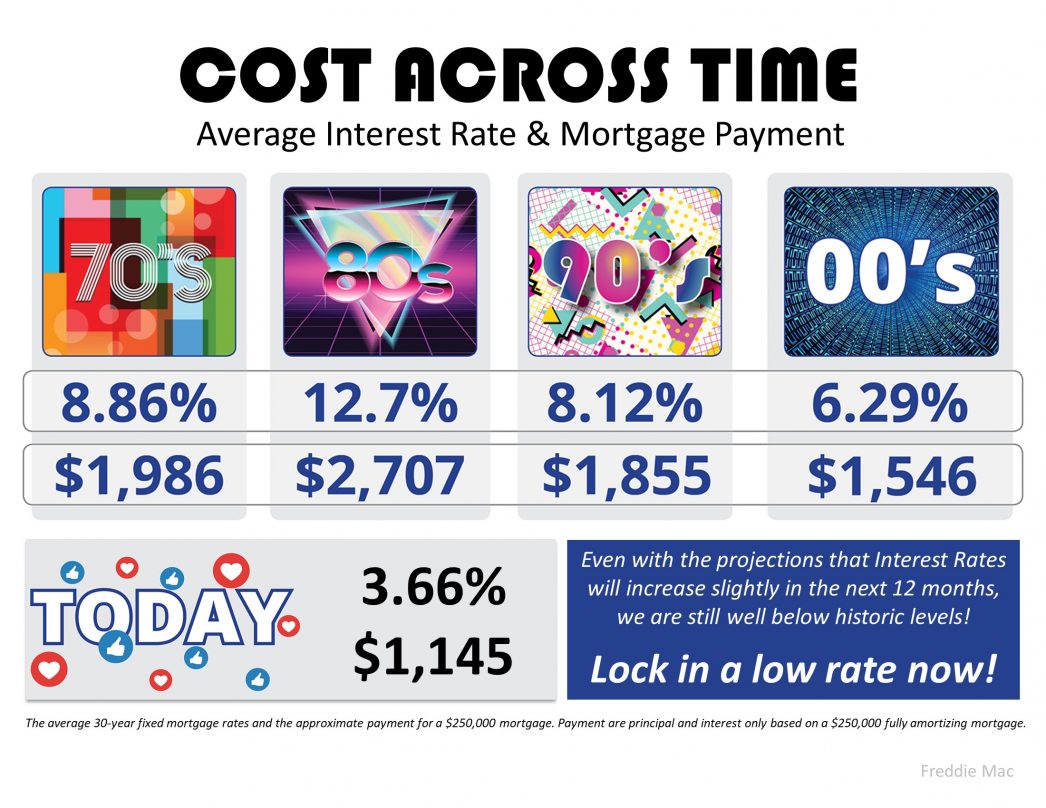

- With interest rates around 3.66%, now is a great time to look back at where they’ve been over the past few decades. Comparatively, they’re pretty low!

- According to Freddie Mac, rates are projected to increase to 3.9% by this time next year.

- The impact your interest rate has on your monthly mortgage payment is significant. An increase of just $20 dollars in your monthly payment can add up to $240 per year and $7,200 over the life of your loan.

- Maybe it’s time to lock in now, while rates are still historically low.

To view original article, visit Keeping Current Matters.

Why Today’s Foreclosure Numbers Are Nothing Like 2008

While foreclosures are climbing, it’s clear foreclosure activity now is nothing like it was during the housing crisis.

What Are the Experts Saying About the Spring Housing Market?

Buyers are going to see more competition than they might expect because there are not many homes on the market.

The Power of Pre-Approval

Pre-approval gives you critical information about the homebuying process that’ll help you understand how much you may be able to borrow.

What’s the Difference Between a Home Inspection and an Appraisal?

Your trusted real estate professional will help you navigate both the inspection as well as any issues that arise during the buying process.

5 Reasons Millennials Are Buying Homes

The top reasons include building equity, a change in life stage, wanting stability, rising home values, and wanting to make somewhere truly their own.

Think Twice Before Waiting for Lower Home Prices

The best way to understand what home values are doing is to work with a local real estate agent who can give you the latest insights.

.jpg )