“According to Freddie Mac, rates are projected to increase to 3.9% by this time next year.”

Some Highlights:

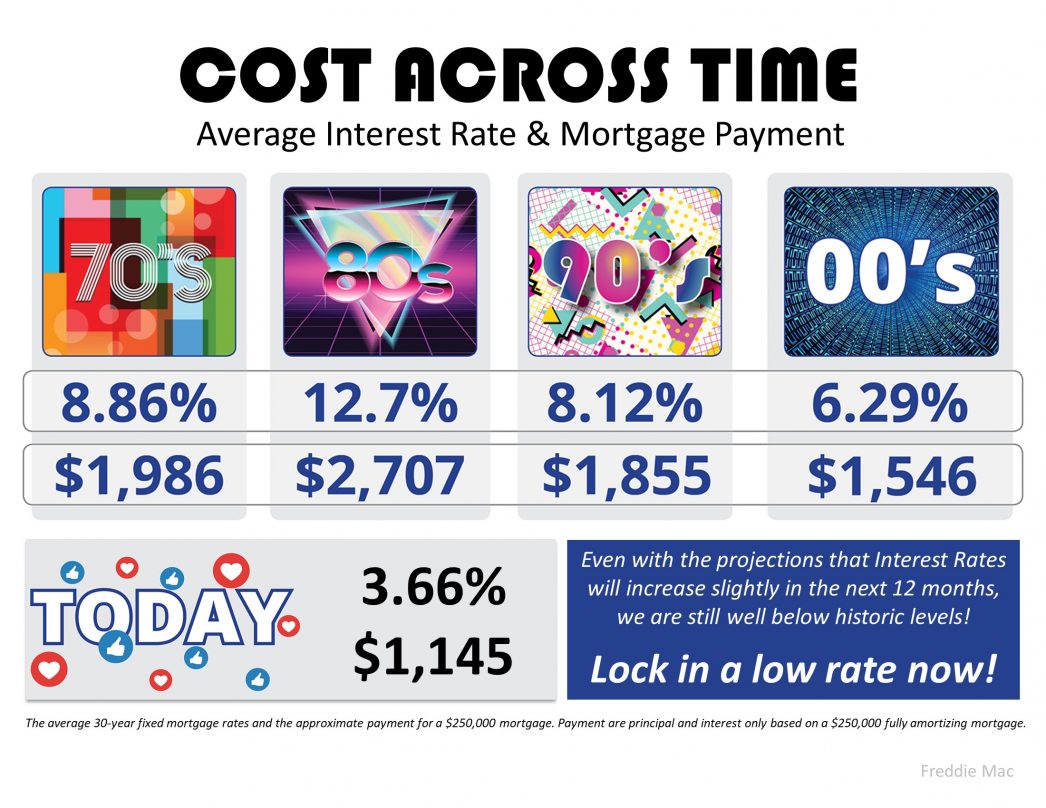

- With interest rates around 3.66%, now is a great time to look back at where they’ve been over the past few decades. Comparatively, they’re pretty low!

- According to Freddie Mac, rates are projected to increase to 3.9% by this time next year.

- The impact your interest rate has on your monthly mortgage payment is significant. An increase of just $20 dollars in your monthly payment can add up to $240 per year and $7,200 over the life of your loan.

- Maybe it’s time to lock in now, while rates are still historically low.

To view original article, visit Keeping Current Matters.

The Big Advantage If You Sell This Spring

Thinking about selling your house? If you’ve been waiting for the right time, it could be now while the supply of homes for sale is so low.

Homebuyer Activity Shows Signs of Warming Up for Spring

The recent uptick in mortgage applications, and the decline in mortgage rates, is good news for sellers!

Trying To Buy a Home? Hang in There.

As we move into the spring buying season, even though we are still in a sellers’ market, mortgage rates have ticked lower, a welcomed sign of progress towards affordability.

Two Reasons You Should Sell Your House

Wondering if you should sell your house this year? As you make your decision, think about what’s motivating you to consider moving and let’s connect today!

How Changing Mortgage Rates Can Affect You

It’s critical to lean on your expert real estate advisors to explore your mortgage options and understand what impacts mortgage rates.

We’re in a Sellers’ Market. What Does That Mean?

Right now, there are still buyers who are ready, willing, and able to purchase a home. List your home at the right price 🙂

.jpg )