“According to Freddie Mac, rates are projected to increase to 3.9% by this time next year.”

Some Highlights:

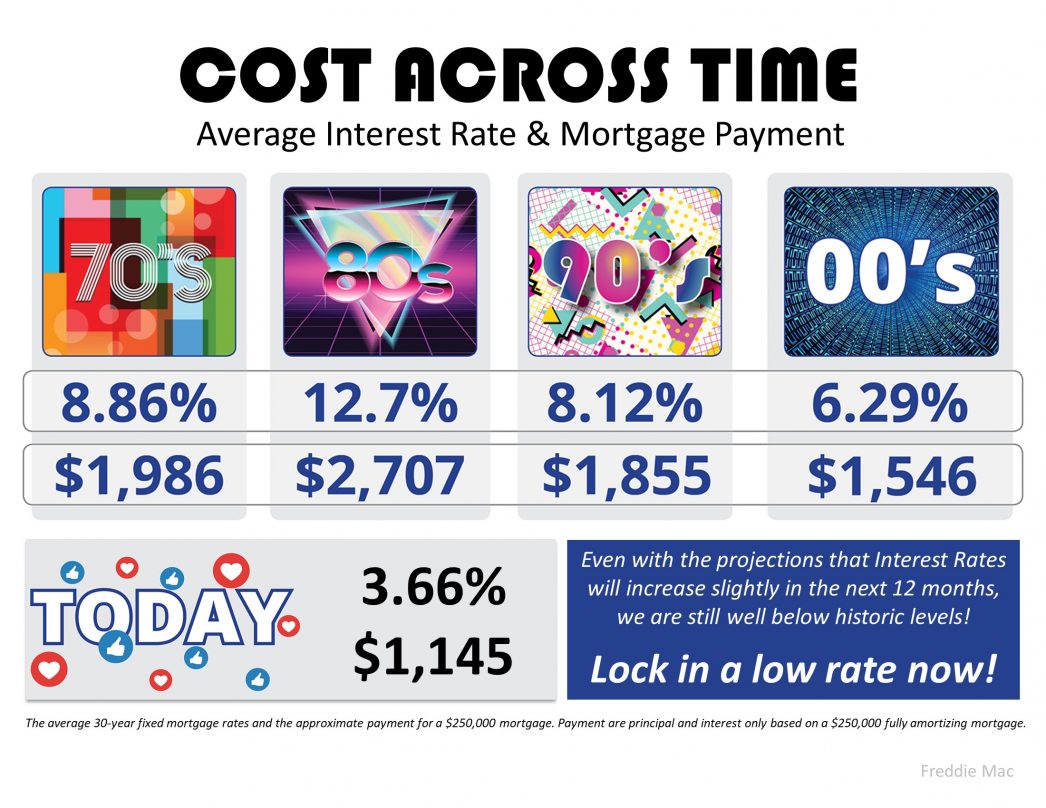

- With interest rates around 3.66%, now is a great time to look back at where they’ve been over the past few decades. Comparatively, they’re pretty low!

- According to Freddie Mac, rates are projected to increase to 3.9% by this time next year.

- The impact your interest rate has on your monthly mortgage payment is significant. An increase of just $20 dollars in your monthly payment can add up to $240 per year and $7,200 over the life of your loan.

- Maybe it’s time to lock in now, while rates are still historically low.

To view original article, visit Keeping Current Matters.

Buying Beats Renting in 22 Major U.S. Cities

Whether you live in one of these budget-friendly cities or any town in-between, it’s time to to talk a local real estate agent to get started.

Don’t Fall for These Real Estate Agent Myths

Don’t let myths keep you from the expert guidance you deserve. A trusted local real estate agent isn’t just helpful, they’re invaluable.

The Down Payment Assistance You Didn’t Know About

Believe it or not, almost 80% of first-time homebuyers qualify for down payment assistance, but only 13% actually use it.

Is Your House Priced Too High?

Pricing your house correctly is one of the most crucial steps in the selling process and if you’re asking too much you may be turning potential buyers away.

Falling Mortgage Rates Are Bringing Buyers Back

If you’ve been hesitant to list your house because you’re worried no one’s buying, here’s your sign it may be time to talk with an agent.

Mortgage Rates Drop to Lowest Level in over a Year and a Half

Mortgage rates have fallen more than half a percent . . . and are at their lowest level since February 2023.

.jpg )