“According to Freddie Mac, rates are projected to increase to 3.9% by this time next year.”

Some Highlights:

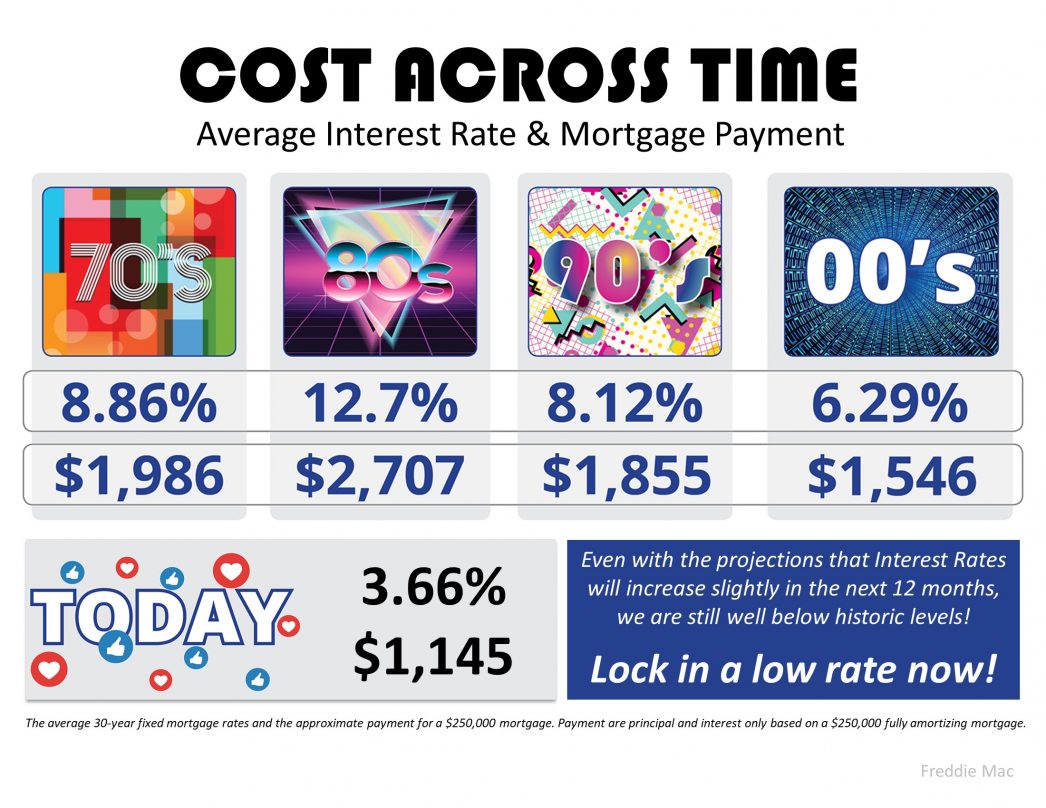

- With interest rates around 3.66%, now is a great time to look back at where they’ve been over the past few decades. Comparatively, they’re pretty low!

- According to Freddie Mac, rates are projected to increase to 3.9% by this time next year.

- The impact your interest rate has on your monthly mortgage payment is significant. An increase of just $20 dollars in your monthly payment can add up to $240 per year and $7,200 over the life of your loan.

- Maybe it’s time to lock in now, while rates are still historically low.

To view original article, visit Keeping Current Matters.

The Biggest Mistakes Sellers Are Making Right Now

If you aren’t working with an agent, you may not realize the mistakes you are making. And they may be costing you!

Are Home Prices Going to Come Down?

In the context of today’s housing market, it doesn’t mean home prices are going to fall dramatically. It only means prices are normalizing a bit.

How the Economy Impacts Mortgage Rates

Mortgage rates will continue to be volatile in the months ahead. There are signs the economy is headed in the better direction.

How Affordability and Remote Work Are Changing Where People Live

An experienced local agent can help you find the lifestyle you’re looking for in a home you can afford.

Unlocking Homebuyer Opportunities in 2024

If you’re ready and able to buy, you may find that the second half of 2024 is a bit easier to navigate.

How To Determine if You’re Ready To Buy a Home

While housing market conditions are definitely a factor in your decision, your own personal situation and your finances matter too.

.jpg )