“There are 39% fewer homes for sale today than at this time last year, and buyer demand continues to set records.”

Housing inventory is at an all-time low. There are 39% fewer homes for sale today than at this time last year, and buyer demand continues to set records. Zillow recently reported:

“Newly pending sales are up 25.5% compared to the same week last year, the highest year-over-year increase in the weekly Zillow database.”

Whenever there is a shortage in supply of an item that’s in high demand, the price of that item increases. That’s exactly what’s happening in the real estate market right now. CoreLogic’s latest Home Price Index reports that values have increased by 5.5% over the last year.

This is great news if you’re planning to sell your house; on the other hand, as either a first-time or repeat buyer, this may instead seem like troubling news. However, purchasers should realize that the price of a house is not as important as the cost. Let’s break it down.

There are several factors that influence the cost of a home. The two major ones are the price of the home and the interest rate at which a buyer can borrow the funds necessary to purchase the home.

Last week, Freddie Mac announced that the average interest rate for a 30-year fixed-rate mortgage was 2.87%. At this time last year, the rate was 3.73%. Let’s use an example to see how that difference impacts the true cost of a home.

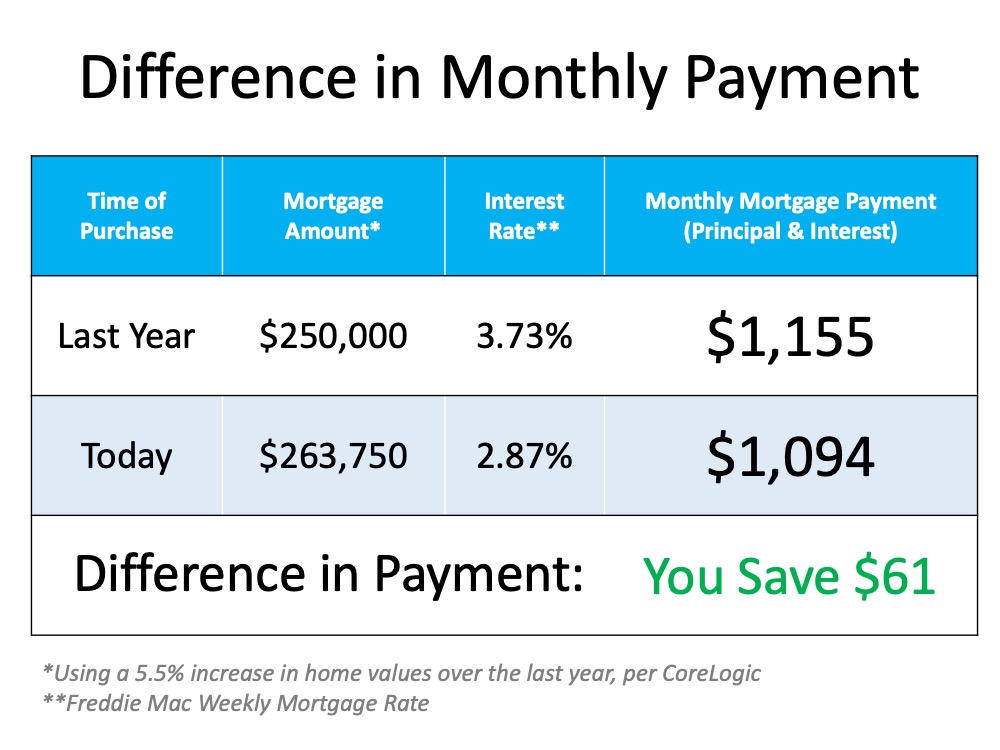

Assume you purchased a home last year and took out a $250,000 mortgage. As mentioned above, home values have increased by 5.5% over the last year. To buy that same home this year, you would need to take out a mortgage of $263,750.

How will your monthly mortgage payment change based on today’s lower mortgage rate?

This table calculates the difference in your monthly payment: That’s a savings of $61 monthly, which adds up to $732 annually and $21,960 over the life of the loan.

That’s a savings of $61 monthly, which adds up to $732 annually and $21,960 over the life of the loan.

Bottom Line

Even though home values have appreciated, it’s a great time to buy a home because mortgage rates are at historic lows.

To view original article, visit Keeping Current Matters.

Should I Buy a Home Now or Wait?

Yes, today’s housing market has challenges, but the key is making a move when it makes sense for you, rather than waiting for a perfect scenario that may never arrive.

Pre-Approval Isn’t Commitment – It’s Clarity

Pre-approval isn’t about jumping the gun or rushing your timeline. It’s about making sure you’re ready when it’s go-time.

What You Can Do When Mortgage Rates Are a Moving Target

You can get the best rate possible in today’s market by controlling your credit score, loan type, and loan term..

Are You Saving Up to Buy a Home? Your Tax Refund Can Help

If you’re getting a tax refund this year, you can use it to help you pay for some of the upfront costs that come with buying a home.

Don’t Miss This Prime Spring Window To Sell Your House

By targeting late spring, sellers can get their home listed when the most shoppers are looking.

4 Ways to Make an Offer That Stands Out This Spring

If you’re serious about landing a home you’ll love, you need a smart strategy that includes a working with a great agent.

.jpg )