“There are 39% fewer homes for sale today than at this time last year, and buyer demand continues to set records.”

Housing inventory is at an all-time low. There are 39% fewer homes for sale today than at this time last year, and buyer demand continues to set records. Zillow recently reported:

“Newly pending sales are up 25.5% compared to the same week last year, the highest year-over-year increase in the weekly Zillow database.”

Whenever there is a shortage in supply of an item that’s in high demand, the price of that item increases. That’s exactly what’s happening in the real estate market right now. CoreLogic’s latest Home Price Index reports that values have increased by 5.5% over the last year.

This is great news if you’re planning to sell your house; on the other hand, as either a first-time or repeat buyer, this may instead seem like troubling news. However, purchasers should realize that the price of a house is not as important as the cost. Let’s break it down.

There are several factors that influence the cost of a home. The two major ones are the price of the home and the interest rate at which a buyer can borrow the funds necessary to purchase the home.

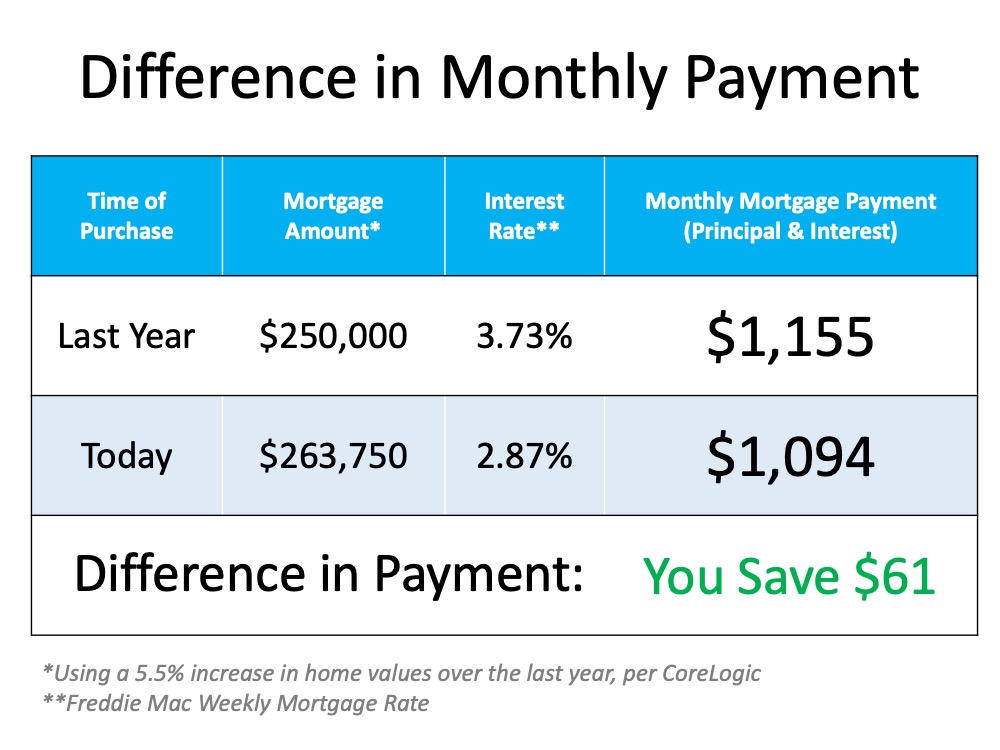

Last week, Freddie Mac announced that the average interest rate for a 30-year fixed-rate mortgage was 2.87%. At this time last year, the rate was 3.73%. Let’s use an example to see how that difference impacts the true cost of a home.

Assume you purchased a home last year and took out a $250,000 mortgage. As mentioned above, home values have increased by 5.5% over the last year. To buy that same home this year, you would need to take out a mortgage of $263,750.

How will your monthly mortgage payment change based on today’s lower mortgage rate?

This table calculates the difference in your monthly payment: That’s a savings of $61 monthly, which adds up to $732 annually and $21,960 over the life of the loan.

That’s a savings of $61 monthly, which adds up to $732 annually and $21,960 over the life of the loan.

Bottom Line

Even though home values have appreciated, it’s a great time to buy a home because mortgage rates are at historic lows.

To view original article, visit Keeping Current Matters.

The Majority of Veterans Are Unaware of a Key VA Loan Benefit

VA home loans are designed to make homeownership a reality for those who have served our country.

Renting vs. Buying: The Net Worth Gap You Need To See

If you’re on the fence, it may be helpful to speak with a local real estate agent. They can help you weigh your options.

Expect the Unexpected: Anticipating Volatility in Today’s Housing Market

Understanding what’s happening will help you make the right decisions, whether that’s buying or selling.

Is a Fixer Upper Right for You?

The perfect home is the one you perfect after buying it. With careful planning, budgeting, and a little bit of vision, you can turn a house that needs some love into your perfect home.

How Real Estate Agents Take the Fear Out of Moving

Real estate agents are trusted guides to help you navigate the complexities of the housing market with confidence and ease.

Why Home Sales Bounce Back After Presidential Elections

As has been the case before, once the election uncertainty passes, buyers and sellers will return to the market.

.jpg )