“VA loans have helped countless Veterans achieve the dream of homeownership.”

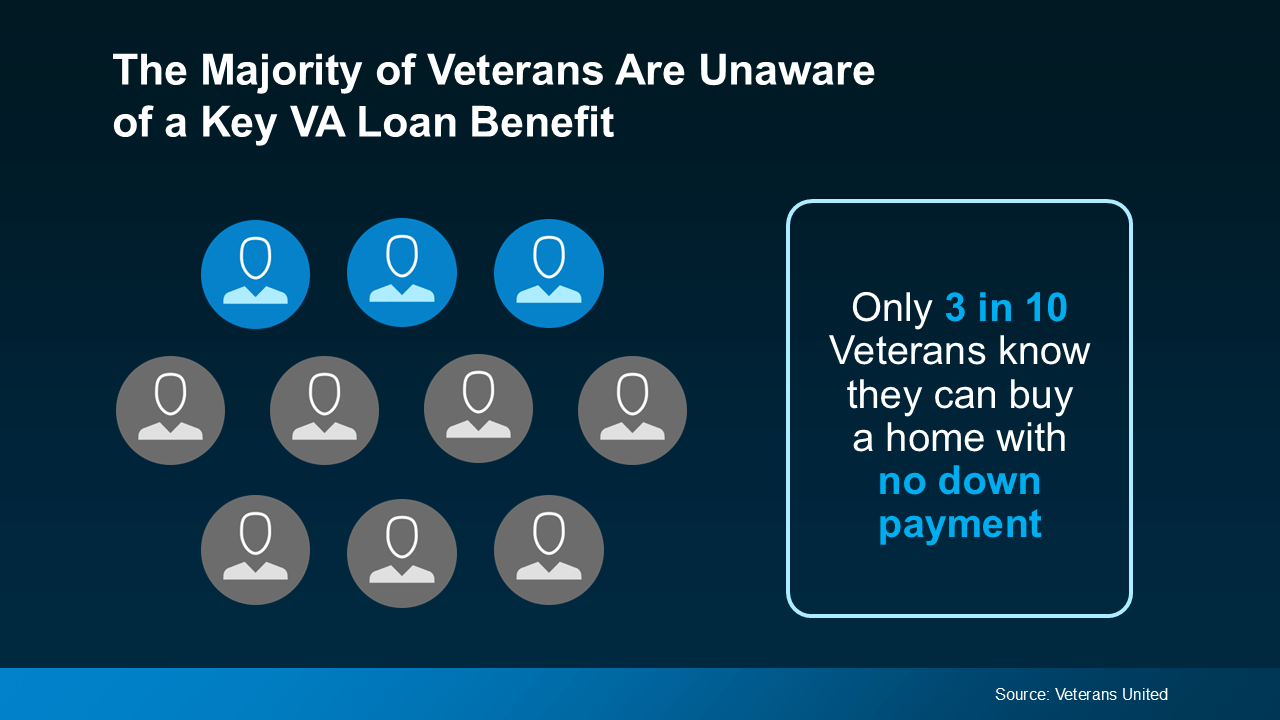

For over 79 years, Veterans Affairs (VA) home loans have helped countless Veterans achieve the dream of homeownership. But according to Veterans United, only 3 in 10 Veterans realize they may be able to buy a home without needing a down payment (see visual below):

That’s why it’s so important for Veterans – and anyone who cares about a Veteran – to be aware of this valuable program. Knowing about the resources available can make the path to homeownership easier and keep life-changing plans from being put on hold. As Veterans United explains:

That’s why it’s so important for Veterans – and anyone who cares about a Veteran – to be aware of this valuable program. Knowing about the resources available can make the path to homeownership easier and keep life-changing plans from being put on hold. As Veterans United explains:

“The ability to buy with 0% down is the signature advantage of this nearly 80-year-old benefit program. Eligible Veterans can buy as much house as they can afford, all without the need to spend years saving for a down payment.”

The Advantages of VA Home Loans

VA home loans are designed to make homeownership a reality for those who have served our country. These loans come with the following benefits according to the Department of Veterans Affairs:

- Options for No Down Payment: One of the biggest perks is that many Veterans can buy a home with no down payment at all, making it simpler to get started on your homebuying journey.

- Limited Closing Costs: With VA loans, there are limits on the types of closing costs Veterans have to pay. This helps keep more money in your pocket when you’re ready to finalize the sale.

- No Private Mortgage Insurance (PMI): Unlike many other loan types, VA loans don’t require PMI, even with lower down payments. This means lower monthly payments, which adds up to big savings over time.

Your team of expert real estate professionals, including a local agent and a trusted lender, are the best resource to understand all the options and advantages available to help you achieve your homebuying goals.

Bottom Line

Owning a home is a key part of the American Dream, and VA home loans are a powerful benefit for those who’ve served our country. Let’s connect to make sure you have everything you need to make confident decisions in the housing market.

To view original article, visit Keeping Current Matters.

Why You Don’t Want To Skip Your Home Inspection

Skipping a home inspection is a risk that could cost you a lot more than just time.

The #1 Thing Sellers Need To Know About Their Asking Price

A great agent will use real data and market trends to make sure your house is priced based on what your specific home is valued at today

The Truth About Newly Built Homes and Today’s Market

Like anything else in real estate, the level of supply and demand will vary by market; some markets have more, some less.

Paused Your Moving Plans? Here’s Why It Might Be Time To Hit Play Again

With inventory still almost 23% below the pre-pandemic norm, well-priced homes are selling.

House Hunting Just Got Easier – Here’s Why

Over the past few months, the number of new listings, or homes that have recently been put on the market for sale, has been steadily rising.

Buyers Have More Negotiation Power – Here’s How to Use It

Negotiating is a complex process. Lean on your agent for expert advice about what’s realistic to ask for and what’s not.

.jpg )