“VA loans have helped countless Veterans achieve the dream of homeownership.”

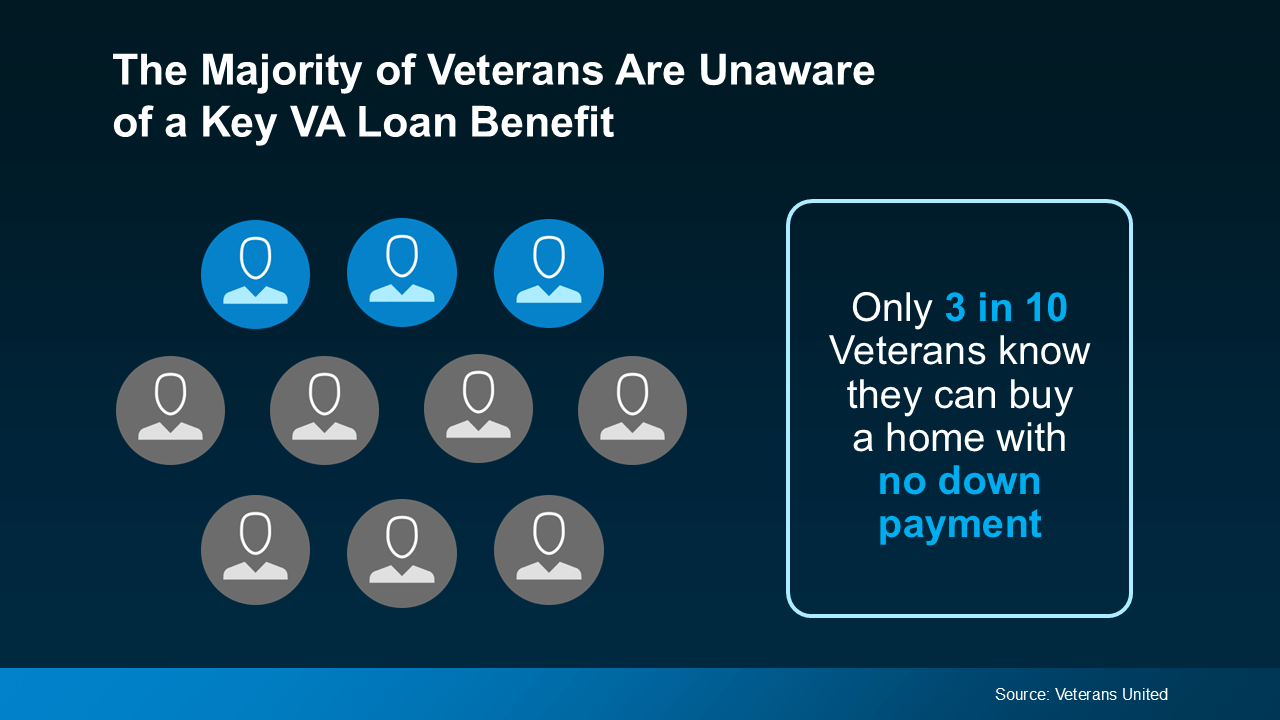

For over 79 years, Veterans Affairs (VA) home loans have helped countless Veterans achieve the dream of homeownership. But according to Veterans United, only 3 in 10 Veterans realize they may be able to buy a home without needing a down payment (see visual below):

That’s why it’s so important for Veterans – and anyone who cares about a Veteran – to be aware of this valuable program. Knowing about the resources available can make the path to homeownership easier and keep life-changing plans from being put on hold. As Veterans United explains:

That’s why it’s so important for Veterans – and anyone who cares about a Veteran – to be aware of this valuable program. Knowing about the resources available can make the path to homeownership easier and keep life-changing plans from being put on hold. As Veterans United explains:

“The ability to buy with 0% down is the signature advantage of this nearly 80-year-old benefit program. Eligible Veterans can buy as much house as they can afford, all without the need to spend years saving for a down payment.”

The Advantages of VA Home Loans

VA home loans are designed to make homeownership a reality for those who have served our country. These loans come with the following benefits according to the Department of Veterans Affairs:

- Options for No Down Payment: One of the biggest perks is that many Veterans can buy a home with no down payment at all, making it simpler to get started on your homebuying journey.

- Limited Closing Costs: With VA loans, there are limits on the types of closing costs Veterans have to pay. This helps keep more money in your pocket when you’re ready to finalize the sale.

- No Private Mortgage Insurance (PMI): Unlike many other loan types, VA loans don’t require PMI, even with lower down payments. This means lower monthly payments, which adds up to big savings over time.

Your team of expert real estate professionals, including a local agent and a trusted lender, are the best resource to understand all the options and advantages available to help you achieve your homebuying goals.

Bottom Line

Owning a home is a key part of the American Dream, and VA home loans are a powerful benefit for those who’ve served our country. Let’s connect to make sure you have everything you need to make confident decisions in the housing market.

To view original article, visit Keeping Current Matters.

Housing Market Forecast: What’s Ahead for the 2nd Half of 2024

Here’s what experts say you should expect for home prices, mortgage rates, and home sales.

Why a Vacation Home Is the Ultimate Summer Upgrade

If you’re excited about getting away and having some fun in the sun, it might make sense to own your own vacation home.

What You Need To Know About Today’s Down Payment Programs

If you want more information on down payment programs, the best place to start is by contacting a trusted real estate professional.

Worried About Mortgage Rates? Control the Controllables

Remember, you can’t control what happens in the broader economy. But you can control the controllables.

Home Prices Aren’t Declining, But Headlines Might Make You Think They Are

Here’s what’s really happening with home prices.

Your Equity Could Make a Move Possible

Today’s mortgage rates are higher than the one they currently have on their home, and that’s making it harder to want to sell and make a move. Equity can help you make your move.

.jpg )