“Despite what you may be hearing in the news, nationally, home prices aren’t falling.”

If you’re thinking of making a move, one of the biggest questions you have right now is probably: what’s happening with home prices? Despite what you may be hearing in the news, nationally, home prices aren’t falling. It’s just that price growth is beginning to normalize. Here’s the context you need to really understand that trend.

In the housing market, there are predictable ebbs and flows that happen each year. It’s called seasonality. Spring is the peak homebuying season when the market is most active. That activity is typically still strong in the summer but begins to wane as the cooler months approach. Home prices follow along with seasonality because prices appreciate most when something is in high demand.

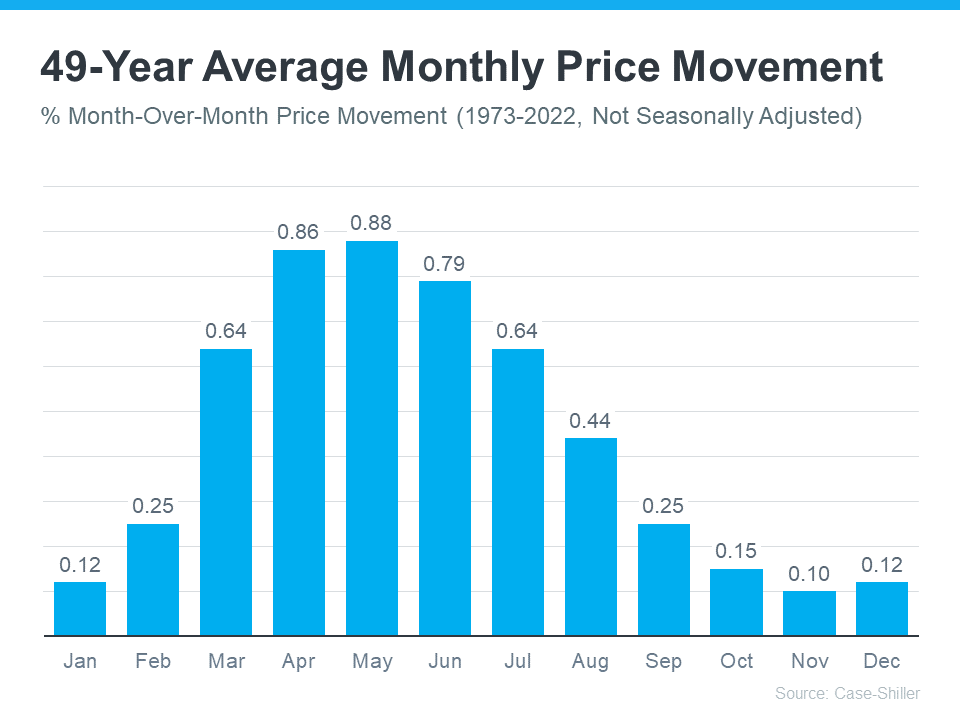

That’s why there’s a reliable long-term home price trend. The graph below uses data from Case-Shiller to show typical monthly home price movement from 1973 through 2022 (not adjusted, so you can see the seasonality):

As the data shows, at the beginning of the year, home prices grow, but not as much as they do in the spring and summer markets. That’s because the market is less active in January and February since fewer people move in the cooler months. As the market transitions into the peak homebuying season in the spring, activity ramps up, and home prices go up a lot more in response. Then, as fall and winter approach, activity eases again. Price growth slows, but still typically appreciates.

After several unusual ‘unicorn’ years, today’s higher mortgage rates helped usher in the first signs of the return of seasonality. As Selma Hepp, Chief Economist at CoreLogic, explains:

“High mortgage rates have slowed additional price surges, with monthly increases returning to regular seasonal averages. In other words, home prices are still growing but are in line with historic seasonal expectations.”

Why This Is So Important to Understand

In the coming months, you’re going to see the media talk more about home prices. In their coverage, you’ll likely see industry terms like these:

- Appreciation: when prices increase.

- Deceleration of appreciation: when prices continue to appreciate, but at a slower or more moderate pace.

- Depreciation: when prices decrease.

Don’t let the terminology confuse you or let any misleading headlines cause any unnecessary fear. The rapid pace of home price growth the market saw in recent years was unsustainable. It had to slow down at some point and that’s what we’re starting to see – deceleration of appreciation, not depreciation.

Remember, it’s normal to see home price growth slow down as the year goes on. And that definitely doesn’t mean home prices are falling. They’re just rising at a more moderate pace.

Bottom Line

While the headlines are generating fear and confusion on what’s happening with home prices, the truth is simple. Home price appreciation is returning to normal seasonality. If you have questions about what’s happening with prices in our local area, let’s connect.

To view original article, visit Keeping Current Matters.

Why It’s Still Safe To Sell Your Home

Real estate professionals use new technology, tools, cleaning procedures, and the latest guidance to meet your changing needs and to keep you safe.

Understand Your Options To Avoid Foreclosure

There are alternatives available to help you avoid having to go through the foreclosure process and a real estate professional can help you.

Home Price Appreciation Is Skyrocketing in 2021. What About 2022?

Price appreciation is expected to slow in 2022 when compared to the record highs of 2021.

Reasons You Should Consider Selling This Fall

If you’re trying to decide when to sell your house, there may not be a better time to list than right now.

5 Reasons Today’s Housing Market Is Anything but Normal

The market is still extremely vibrant as demand is still strong even while housing supply is slowly returning.

What You Can Do Right Now To Prepare for Homeownership

It’s important to talk to someone who understands the market and what it takes to become a first-time homebuyer.

.jpg )