“Investor buying activity in the U.S. is at record highs.”

Over 10% of all residential homes are purchased by investors, and that number continues to rise. Who are these investors?

Many have speculated that the large institutional conglomerates such as Blackstone, American Homes 4 Rent, and Colony Starwood dominate investor purchases. However, a special report on investor home buying by CoreLogic, Don’t Call it a Comeback: Housing Investors Have Been Here for Years, shows this is not the case.

Ralph McLaughlin, CoreLogic’s Deputy Chief Economist and author of the report, explained his findings at the recent National Association of Real Estate Editors conference in Austin:

“Investor buying activity in the U.S. is at record highs. And our records go back confidently, about 20 years…

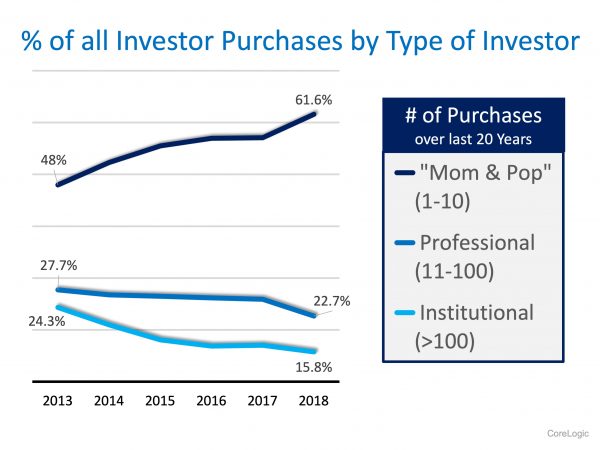

What’s going on and why? Well, it turns out, it’s not the big institutional guys that are leading the increase in home buying. It’s actually the smaller guys. It’s those that have bought between one and ten properties over this 20-year period, they’re the ones that are really leading the increase in investor home buying.”

Here is the breakdown of the percentage of purchasers by type of investor over the last six years according to the report: As the graph shows, the percentage of “Mom & Pop” investors is currently dominating the number of homes purchased by investors, as the percentage of homes purchased by both professional and institutional investors is falling.

As the graph shows, the percentage of “Mom & Pop” investors is currently dominating the number of homes purchased by investors, as the percentage of homes purchased by both professional and institutional investors is falling.

Bottom Line

Most houses purchased by an investor are bought by small investors looking to diversify their financial portfolio by adding a real estate component. If you are investing in real estate as either a landlord or someone who fixes-up and flips the house, let’s chat about the ways you can build or liquidate your current portfolio of properties.

To view original article, visit Keeping Current Matters.

U.S. Homeownership Rate Rises to Highest Point in 8 Years

Homeownership is an important part of the American dream, especially in moments like this.

How to Test-Drive a Neighborhood While Sheltering in Place

Check out these tips on how to explore other neighborhoods virtually in the homebuying process.

Why the Housing Market Is a Powerful Economic Driver

Buying a home is a driving financial force in the recovery of the U.S. economy. Are you ready to make a move?

Buying a Home Right Now: Easy? No. Smart? Yes.

Many families have decided not to postpone their plans to purchase a home, even in these difficult times.

What Impact Might COVID-19 Have on Home Values?

A big challenge facing the housing industry is determining what impact the current pandemic may have on home values.

Uncertainty Abounds in the Search for Economic Recovery Timetable

The current situation makes it extremely difficult to project the future of the economy. Analysts are hoping for a quick recovery.

.jpg )