“Investor buying activity in the U.S. is at record highs.”

Over 10% of all residential homes are purchased by investors, and that number continues to rise. Who are these investors?

Many have speculated that the large institutional conglomerates such as Blackstone, American Homes 4 Rent, and Colony Starwood dominate investor purchases. However, a special report on investor home buying by CoreLogic, Don’t Call it a Comeback: Housing Investors Have Been Here for Years, shows this is not the case.

Ralph McLaughlin, CoreLogic’s Deputy Chief Economist and author of the report, explained his findings at the recent National Association of Real Estate Editors conference in Austin:

“Investor buying activity in the U.S. is at record highs. And our records go back confidently, about 20 years…

What’s going on and why? Well, it turns out, it’s not the big institutional guys that are leading the increase in home buying. It’s actually the smaller guys. It’s those that have bought between one and ten properties over this 20-year period, they’re the ones that are really leading the increase in investor home buying.”

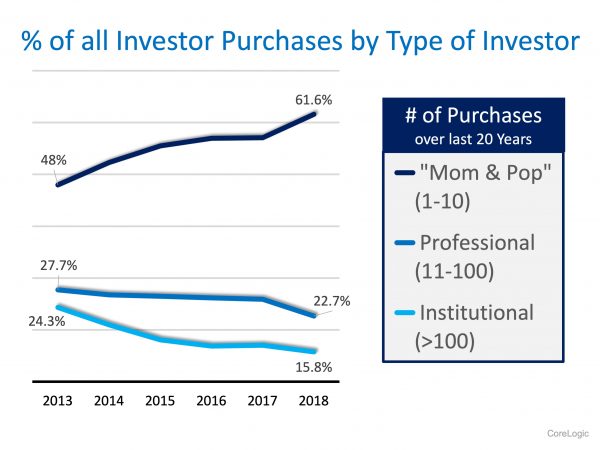

Here is the breakdown of the percentage of purchasers by type of investor over the last six years according to the report: As the graph shows, the percentage of “Mom & Pop” investors is currently dominating the number of homes purchased by investors, as the percentage of homes purchased by both professional and institutional investors is falling.

As the graph shows, the percentage of “Mom & Pop” investors is currently dominating the number of homes purchased by investors, as the percentage of homes purchased by both professional and institutional investors is falling.

Bottom Line

Most houses purchased by an investor are bought by small investors looking to diversify their financial portfolio by adding a real estate component. If you are investing in real estate as either a landlord or someone who fixes-up and flips the house, let’s chat about the ways you can build or liquidate your current portfolio of properties.

To view original article, visit Keeping Current Matters.

A 365 Day Difference in Homeownership

Over the past year, mortgage rates have fallen more than a full percentage point. This is a great driver for homeownership, as today’s low rates provide consumers with some significant benefits.

Have You Budgeted for Closing Costs?

Closing costs are typically between 2% and 5% of your purchase price. Have you planned for this expense? Our agents are here to help you with all your real estate needs!

Millennials Are on the Move As First-Time Homebuyers

National Association of Realtors’ statistics show ‘Old Millennials’ (ages 25-36) are dominating the first-time homebuyer category.

What is the Best Investment for Americans?

Some are reporting that there is trepidation regarding the real estate market in the United States. Not exactly! 🙂

Is A Bigger House Within Your Budget?

At this time of year, many families come together to celebrate the season and often realize that their homes are just not big enough! Is that you? Are you ready for a bigger house?

5 Reasons to Sell This Winter

Strong demand and less competition are only 2 reason why you shouldn’t wait until spring to list your home. Are you ready to make a move?

.jpg )