“Investor buying activity in the U.S. is at record highs.”

Over 10% of all residential homes are purchased by investors, and that number continues to rise. Who are these investors?

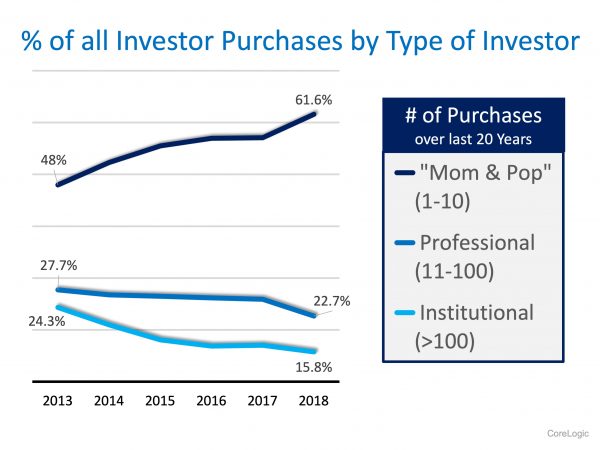

Many have speculated that the large institutional conglomerates such as Blackstone, American Homes 4 Rent, and Colony Starwood dominate investor purchases. However, a special report on investor home buying by CoreLogic, Don’t Call it a Comeback: Housing Investors Have Been Here for Years, shows this is not the case.

Ralph McLaughlin, CoreLogic’s Deputy Chief Economist and author of the report, explained his findings at the recent National Association of Real Estate Editors conference in Austin:

“Investor buying activity in the U.S. is at record highs. And our records go back confidently, about 20 years…

What’s going on and why? Well, it turns out, it’s not the big institutional guys that are leading the increase in home buying. It’s actually the smaller guys. It’s those that have bought between one and ten properties over this 20-year period, they’re the ones that are really leading the increase in investor home buying.”

Here is the breakdown of the percentage of purchasers by type of investor over the last six years according to the report: As the graph shows, the percentage of “Mom & Pop” investors is currently dominating the number of homes purchased by investors, as the percentage of homes purchased by both professional and institutional investors is falling.

As the graph shows, the percentage of “Mom & Pop” investors is currently dominating the number of homes purchased by investors, as the percentage of homes purchased by both professional and institutional investors is falling.

Bottom Line

Most houses purchased by an investor are bought by small investors looking to diversify their financial portfolio by adding a real estate component. If you are investing in real estate as either a landlord or someone who fixes-up and flips the house, let’s chat about the ways you can build or liquidate your current portfolio of properties.

To view original article, visit Keeping Current Matters.

This is Not 2008 All Over Again: The Mortgage Lending Factor

Some are afraid the real estate market may be looking a lot like it did prior to the housing crash in 2008.

Buyer Demand Growing in Every Region

Let’s get together to discuss listing your house now while buyer traffic is actively surging throughout the country. Why wait until spring? Call us today!

Homeownership Rate Remains on the Rise

If you’re thinking of buying a home, let’s get together to make your dream a reality. Call BrookHampton Realty today!

75 Years of VA Home Loan Benefits

This year marks the 75th anniversary of VA Home Loan Benefit offerings through the Servicemen’s Readjustment Act, also known as the GI Bill.

VA Home Loans by the Numbers

Veterans Administration Home Loan is a benefit that is available to more than 22 million veterans and 2 million active duty service members.

Forget the Price of the Home. The Cost is What Matters.

The reacceleration of home values may raise concerns about affordability. Discover how market factors impact purchasing power.

.jpg )