“Investor buying activity in the U.S. is at record highs.”

Over 10% of all residential homes are purchased by investors, and that number continues to rise. Who are these investors?

Many have speculated that the large institutional conglomerates such as Blackstone, American Homes 4 Rent, and Colony Starwood dominate investor purchases. However, a special report on investor home buying by CoreLogic, Don’t Call it a Comeback: Housing Investors Have Been Here for Years, shows this is not the case.

Ralph McLaughlin, CoreLogic’s Deputy Chief Economist and author of the report, explained his findings at the recent National Association of Real Estate Editors conference in Austin:

“Investor buying activity in the U.S. is at record highs. And our records go back confidently, about 20 years…

What’s going on and why? Well, it turns out, it’s not the big institutional guys that are leading the increase in home buying. It’s actually the smaller guys. It’s those that have bought between one and ten properties over this 20-year period, they’re the ones that are really leading the increase in investor home buying.”

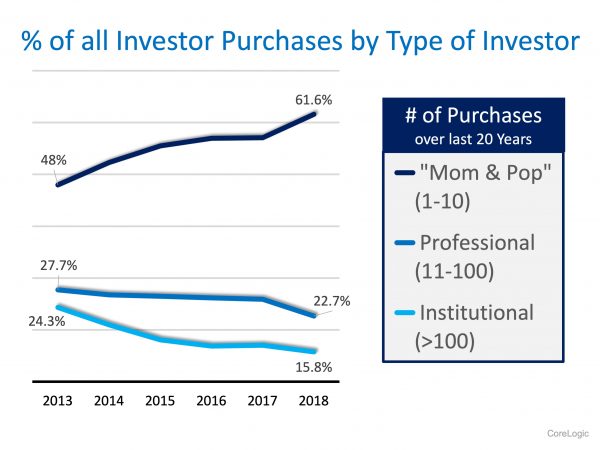

Here is the breakdown of the percentage of purchasers by type of investor over the last six years according to the report: As the graph shows, the percentage of “Mom & Pop” investors is currently dominating the number of homes purchased by investors, as the percentage of homes purchased by both professional and institutional investors is falling.

As the graph shows, the percentage of “Mom & Pop” investors is currently dominating the number of homes purchased by investors, as the percentage of homes purchased by both professional and institutional investors is falling.

Bottom Line

Most houses purchased by an investor are bought by small investors looking to diversify their financial portfolio by adding a real estate component. If you are investing in real estate as either a landlord or someone who fixes-up and flips the house, let’s chat about the ways you can build or liquidate your current portfolio of properties.

To view original article, visit Keeping Current Matters.

The Average Homeowner Gained $64K in Equity over the Past Year

In addition to building your overall net worth, equity can also help you achieve other goals like buying your next home.

More Americans Choose Real Estate as the Best Investment Than Ever Before

Your house is also an asset that typically increases in value over time, even during inflation.

Why You Need an Expert To Determine the Right Price for Your House

Your goal is to aim directly for the center – not too high, not too low, but right at market value.

What Does the Rest of the Year Hold for the Housing Market?

Home prices are forecast to keep appreciating because there are still fewer homes for sale than there are buyers in the market.

Why Summer Is a Great Time To Buy a Vacation Home

The first step is working with a local real estate advisor who can help you find a home in your desired location.

Sellers Have an Opportunity with Today’s Home Prices

If you’re thinking about selling your house, you have a great opportunity to capitalize on today’s home price appreciation.

.jpg )