“Does it make sense to sell your house right now? YES!”

Wondering if it still makes sense to sell your house right now? The short answer is, yes. Especially if you consider how few homes there are for sale today.

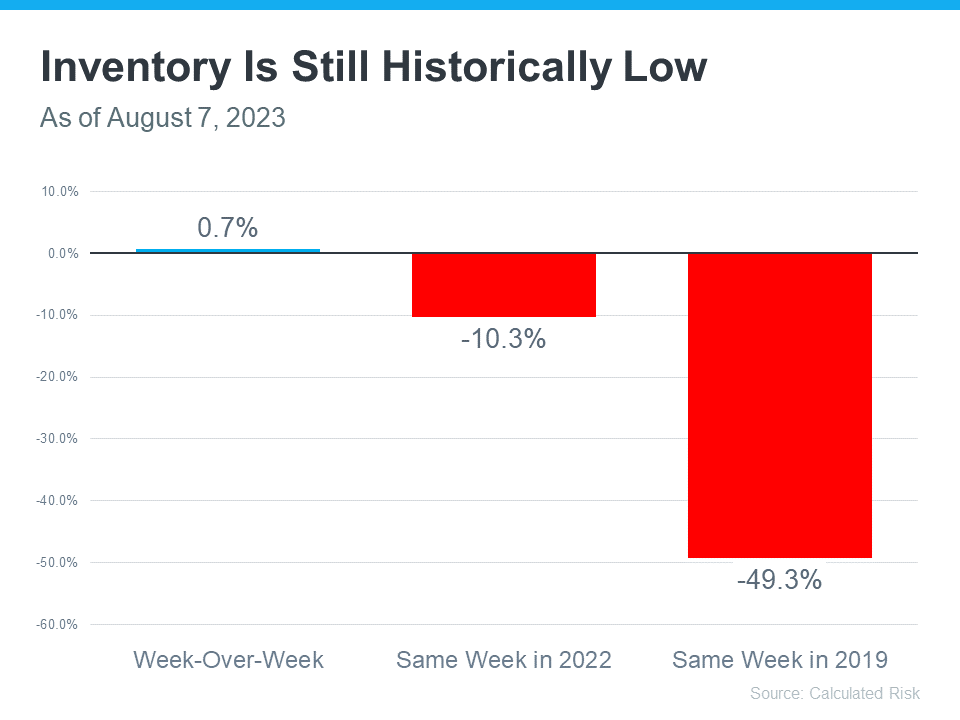

You may have heard inventory is low right now, but you may not fully realize just how low or why that’s a perk when you go to sell your house. This graph from Calculated Risk can help put that into perspective:

As the graph shows, while housing inventory did grow slightly week-over-week (shown in the blue bar), overall supply is still low (shown in the red bars). Compared to the same week last year, supply is down roughly 10% – and it was already considered low at that time. But, if you look further back, you’ll see inventory is down even more significantly.

As the graph shows, while housing inventory did grow slightly week-over-week (shown in the blue bar), overall supply is still low (shown in the red bars). Compared to the same week last year, supply is down roughly 10% – and it was already considered low at that time. But, if you look further back, you’ll see inventory is down even more significantly.

To gauge just how far off from normal today’s inventory is, let’s compare right now to 2019 (the last normal year in the market). When you compare the same week this year with the matching week in 2019, supply is about 50% lower. That means there are half the homes for sale now than there’d usually be.

The key takeaway? We’re still nowhere near what’s considered a balanced market. There’s plenty of demand for your house because there just aren’t enough homes to go around. As Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains:

“There are simply not enough homes for sale. The market can easily absorb a doubling of inventory.”

So, if you want to list your house, know that there’s only about half the inventory there’d usually be in a more normal year. That means your house will be in the spotlight if you sell now and you may see multiple offers and a fast home sale.

Bottom Line

With the number of homes for sale roughly half of what there’d usually be in a more normal year, you can rest assured there’s demand for your house. If you want to sell, let’s connect now so your house can shine above the rest while inventory is so low.

To view original article, visit Keeping Current Matters.

Planning to Move? You Can Still Secure a Low Mortgage Rate on Your Next Home

To take advantage of today’s real estate market, experts are encouraging homeowners to act now before interest rates climb.

How Much Time Do You Need To Save for a Down Payment?

The national average for the time it would take to save for a 10% down payment is right around two and a half years (2.53).

93% of Americans Believe a Home Is a Better Investment Than Stocks

Housing represents the largest asset owned by most households and is a major means of wealth accumulation.

Some Buyers Prefer Smaller Homes

If your house is no longer the best fit for your evolving needs, it may be time to put your equity to work for you and downsize to the home you really want.

Homeownership Is Full of Financial Benefits

Does homeownership actually give you a better chance to build wealth?

Latest Jobs Report: What Does It Mean for You & the Housing Market?

With listing inventory down 52% from a year ago, bidding wars are skyrocketing. As a result, home prices are climbing.

.jpg )