“Before you decide to dip into your retirement to buy a home, be sure to consider all possible alternatives and talk with a financial expert.”

Are you dreaming of buying your own home and wondering about how you’ll save for a down payment? You’re not alone. Some people think about tapping into their 401(k) savings to make it happen. But before you decide to dip into your retirement to buy a home, be sure to consider all possible alternatives and talk with a financial expert. Here’s why.

The Numbers May Make It Tempting

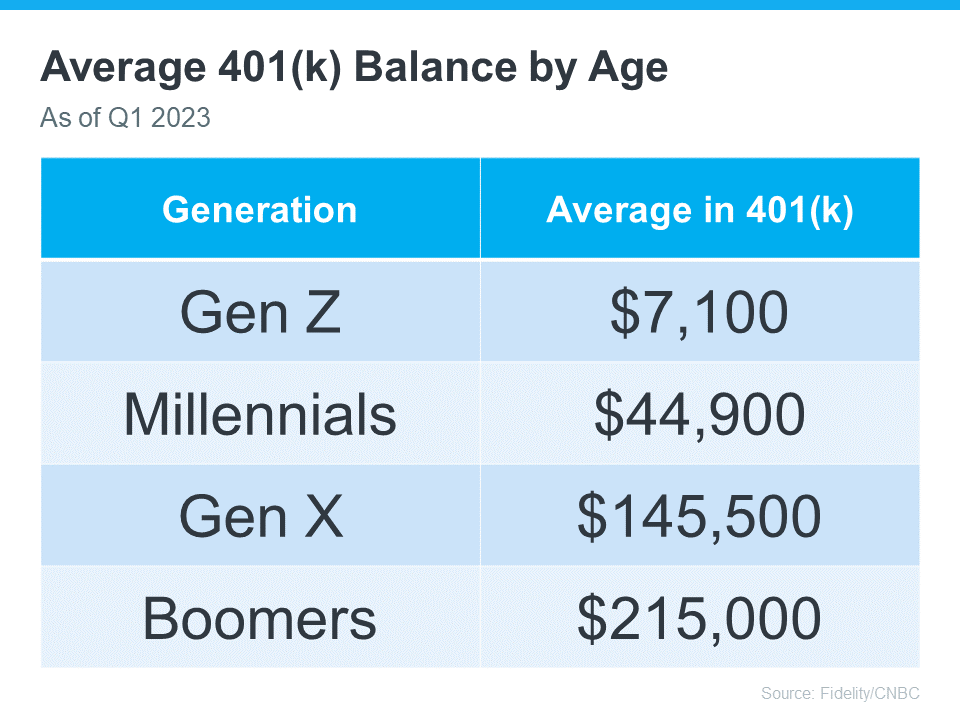

The data shows many Americans have saved a considerable amount for retirement (see chart below):

It can be really tempting when you have a lot of money saved up in your 401(k) and you see your dream home on the horizon. But remember, dipping into your retirement savings for a home could cost you a penalty and affect your finances later on. That’s why it’s important to explore all your options when it comes to saving for a down payment and buying a home. As Experian says:

“It’s possible to use funds from your 401(k) to buy a house, but whether you should depends on several factors, including taxes and penalties, how much you’ve already saved and your unique financial circumstances.”

Alternative Ways To Buy a Home

Using your 401(k) is one way to finance a home, but it’s not the only option. Before you decide, consider a couple of other methods, courtesy of Experian:

- FHA Loan: FHA loans allow qualified buyers to put down as little as 3.5% of the home’s price, depending on their credit scores.

- Down Payment Assistance Programs: There are many national and local programs that can help first-time and repeat homebuyers come up with the necessary down payment.

Above All Else, Have a Plan

No matter what route you take to purchase a home, be sure to talk with a financial expert before you do anything. Working with a team of experts to develop a concrete plan prior to starting your journey to homeownership is the key to success. Kelly Palmer, Founder of The Wealthy Parent, says:

“I have seen parents pausing contributions to their retirement plans in favor of affording a larger home often with the hope they can refinance in the future… As long as there is a tangible plan in place to get back to saving for their retirement goals, I encourage families to consider all their options.”

Bottom Line

If you’re still thinking about using your 401(k)-retirement savings for a home down payment, consider all your options and work with a financial professional before you make any decisions.

To view original article, visit Keeping Current Matters.

Happy Holidays!

From the BrookHampton family to yours, a very Merry Christmas, happy holiday and prosperous New Year! For those who we have had the pleasure of meeting and working with, we wish you all the best and hope that your new home has made this holiday season even more...

4 Reasons to Buy a Home This Winter

If the right thing for you and your family is to purchase a home this year, buying sooner rather than later could lead to substantial savings.

Rents Are on the Rise: Don’t Get Caught in the Rental Trap!

There are many benefits to homeownership. One of the top benefits is protecting yourself from rising rents, by locking in your housing cost for the life of your mortgage.

Feeling ‘Stuck in Place?’ You Aren’t Alone…And There’s Hope!

Whether you are a renter who is searching for your dream home or a homeowner who feels like your only option is to renovate, you have at least one thing in common: feeling suck in place.

Your Friends Are Crazy Wrong If They’re Telling You Not to Buy

The current narrative is that home prices have risen so much so that it is no longer a smart idea to purchase a home. However, homes are more affordable right now than at almost any time in our country’s history, except for the foreclosure years when homes sold at major discounts.

7 Reasons to List Your Home This Holiday Season

Every year at this time, many homeowners decide to wait until after the holidays to put their homes on the market for the first time, while others who already have their homes on the market decide to take them off until after the holidays. Here are seven great reasons not to wait.

.jpg )