“Before you decide to dip into your retirement to buy a home, be sure to consider all possible alternatives and talk with a financial expert.”

Are you dreaming of buying your own home and wondering about how you’ll save for a down payment? You’re not alone. Some people think about tapping into their 401(k) savings to make it happen. But before you decide to dip into your retirement to buy a home, be sure to consider all possible alternatives and talk with a financial expert. Here’s why.

The Numbers May Make It Tempting

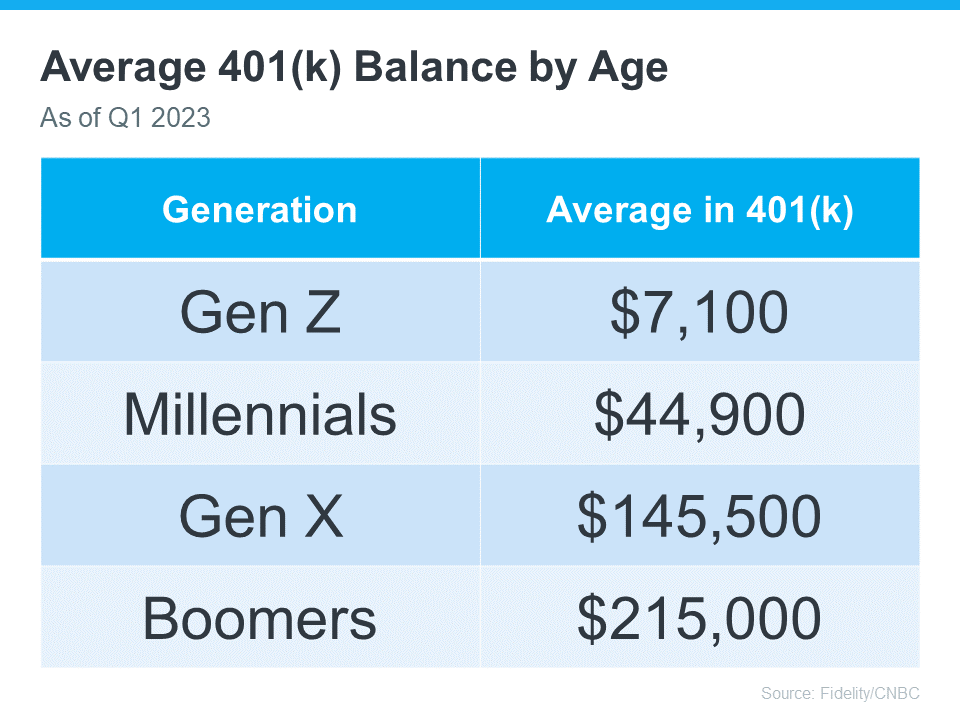

The data shows many Americans have saved a considerable amount for retirement (see chart below):

It can be really tempting when you have a lot of money saved up in your 401(k) and you see your dream home on the horizon. But remember, dipping into your retirement savings for a home could cost you a penalty and affect your finances later on. That’s why it’s important to explore all your options when it comes to saving for a down payment and buying a home. As Experian says:

“It’s possible to use funds from your 401(k) to buy a house, but whether you should depends on several factors, including taxes and penalties, how much you’ve already saved and your unique financial circumstances.”

Alternative Ways To Buy a Home

Using your 401(k) is one way to finance a home, but it’s not the only option. Before you decide, consider a couple of other methods, courtesy of Experian:

- FHA Loan: FHA loans allow qualified buyers to put down as little as 3.5% of the home’s price, depending on their credit scores.

- Down Payment Assistance Programs: There are many national and local programs that can help first-time and repeat homebuyers come up with the necessary down payment.

Above All Else, Have a Plan

No matter what route you take to purchase a home, be sure to talk with a financial expert before you do anything. Working with a team of experts to develop a concrete plan prior to starting your journey to homeownership is the key to success. Kelly Palmer, Founder of The Wealthy Parent, says:

“I have seen parents pausing contributions to their retirement plans in favor of affording a larger home often with the hope they can refinance in the future… As long as there is a tangible plan in place to get back to saving for their retirement goals, I encourage families to consider all their options.”

Bottom Line

If you’re still thinking about using your 401(k)-retirement savings for a home down payment, consider all your options and work with a financial professional before you make any decisions.

To view original article, visit Keeping Current Matters.

Why It’s Easy To Fall in Love with Homeownership

Over the last few years, we’ve fully embraced the meaning of our homes as we spent more time than ever in them.

What You Should Know About Closing Costs

Understanding what closing costs include is important, but knowing what you’ll need to budget to cover them is critical, too.

Number of Homes for Sale Up from Last Year, but Below Pre-Pandemic Years

Your house would be welcome in a market that has fewer homes for sale than it did in the years leading up to the pandemic.

How Experts Can Help Close the Gap in Today’s Homeownership Rate

Homeownership is an essential piece for building household wealth that can be passed down to future generations.

The Top Reasons for Selling Your House

If you also find yourself wanting a change in location, needing more space than your current house can provide or feel the need to downsize, it may be time to sell.

Experts Forecast a Turnaround in the Housing Market in 2023

As we move through 2023, there are signs things are finally going to turn around.

.jpg )