“Today’s market is a sweet spot for buyers—and it’s one that may not last long.”

After months of sitting on the sidelines, many homebuyers who were priced out by high mortgage rates and affordability challenges finally have an opportunity to make their move. With rates trending down, today’s market is a sweet spot for buyers—and it’s one that may not last long.

So, if you’ve put your own move on the back burner, here’s why maybe you shouldn’t delay your plans any longer.

As you weigh your options and decide if you should buy now or wait, ask yourself this: What do you think everyone else is going to do?

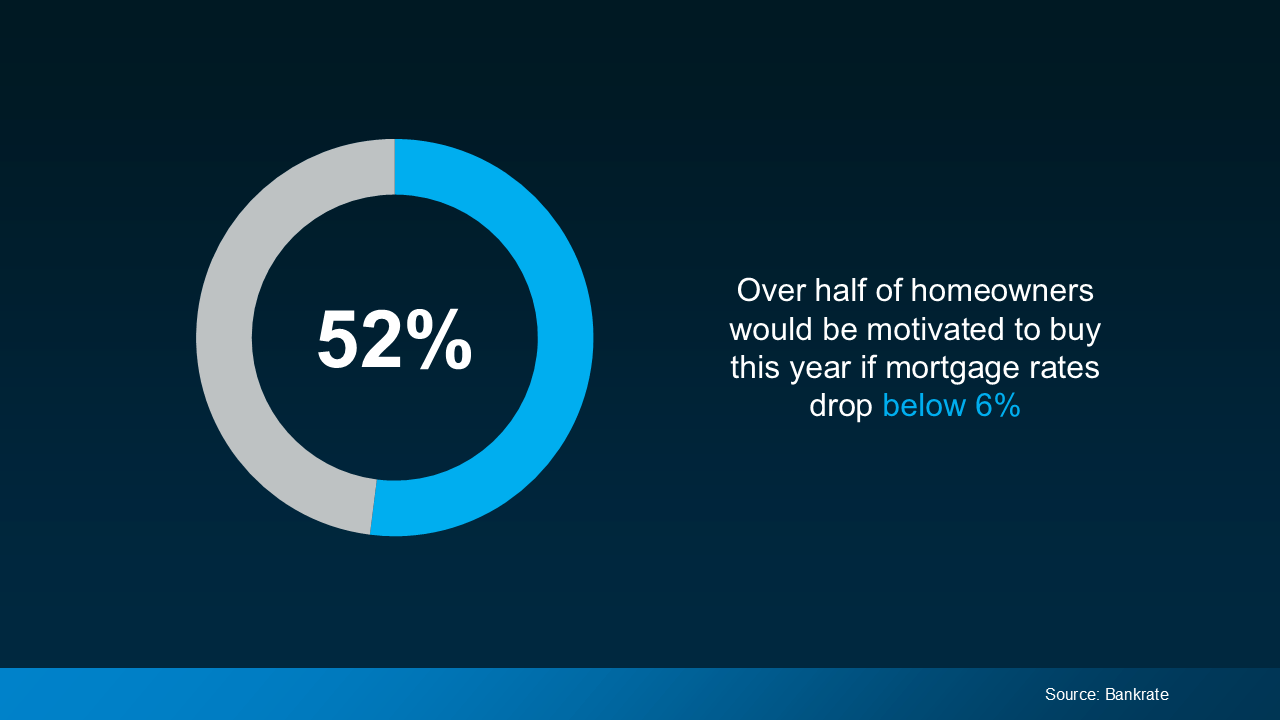

The truth is, if mortgage rates continue to ease, as experts project, more buyers will jump back into the market. A survey from Bankrate shows over half of homeowners would be motivated to buy this year if rates drop below 6% (see graph below):

With rates already in the low 6% range, we’re not terribly far off from hitting that threshold. The bottom line is, that when they drop into the 5s, the number of buyers in the market is going to go up – and that means more competition for you.

With rates already in the low 6% range, we’re not terribly far off from hitting that threshold. The bottom line is, that when they drop into the 5s, the number of buyers in the market is going to go up – and that means more competition for you.

That increased demand will likely push home prices up, which could potentially take away from some of the benefits you’d gain from a slightly lower interest rate. As Nadia Evangelou, Senior Economist and Director of Real Estate Research at the National Association of Realtors (NAR), explains:

“The downside of increased demand is that it puts upward pressure on home prices as multiple buyers compete for a limited number of homes. In markets with ongoing housing shortages, this price increase can offset some of the affordability gains from lower mortgage rates.”

So, while waiting to buy may seem like a smart move, it could backfire if rising prices outpace your savings from slightly lower rates.

What This Means for You

Right now, you’ve got the chance to get ahead of all of that. Today’s market is a buyer sweet spot. Why? Because a lot of other buyers are waiting – which means not as many people are actively looking for homes. That means less competition for you.

At the same time, affordability has already improved quite a bit. Recent easing in mortgage rates has made homeownership more accessible. As Mike Simonsen, Founder of Altos Research, says:

“Mortgage payments on the typical-price home are 7% lower than last year and are 13% lower than the peak in May 2024.”

And while the supply of homes for sale is still low, it’s also higher than it’s been in years. According to Ralph McLaughlin, Senior Economist at Realtor.com:

“The number of homes actively for sale continues to be elevated compared with last year, growing by 35.8%, a 10th straight month of growth, and now sits at the highest since May 2020.”

This means you now have more options to choose from than you’ve had in quite a while.

With fewer buyers in the market, improving affordability, and more homes to choose from, you have the chance to find the right one before the competition heats up.

Why Waiting Could Cost You

If you’re waiting for the perfect time to buy, it’s important to understand that timing the market is nearly impossible. The longer you wait, the higher the risk that market conditions will shift—and not necessarily in your favor. As Greg McBride, Chief Financial Analyst at Bankrate, says:

“It’s one of those things where you should be careful what you wish for. A further drop in mortgage rates could bring a surge of demand that makes it tougher to actually buy a house.”

Bottom Line

Don’t wait until you have to deal with more competition and higher prices – you already have the chance to buy a home while we’re in the sweet spot today. Let’s connect to make sure you’re taking advantage of it.

To view original article, visit Keeping Current Matters.

Why Sell Now Instead of Later? The Buyers are Out Now

The concept of ‘supply & demand’ reveals that the best price for an item will be realized when the supply of that item is low and the demand for that item is high. Recently released data suggests that a seller’s best deal may be available right now.

Vacation Home Property Sales Surge

According to the Beracha, Hardin & Johnson Buy vs. Rent (BH&J) Index, the U.S. housing market has continued to move deeper into buy territory, supporting the belief that housing markets across the country remain a sound investment. The BH&J Index is a...

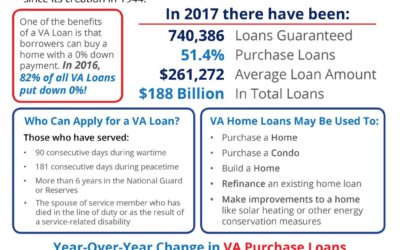

Veterans Affairs Loans by the Numbers

The Veterans Affairs Home Loan is a benefit that has helped more than 22 million veterans achieve the dream of homeownership since its creation in 1944.

Low Inventory Causes Home Prices to Maintain Fast Growth

The National Association of Realtors (NAR) released their latest Quarterly Metro Home Price Report last week. The report revealed that severely lacking inventory across the country drained sales growth and kept home prices rising at a steady clip in nearly all metro...

Multigenerational Households May Be the Answer to Price Increases

Multigenerational homes are coming back in a big way! Nearly 1 in 5 Americans are now living in a multigenerational household.

Buying Remains Cheaper Than Renting in 39 States!

In the latest Rent vs. Buy Report from Trulia, they explained that homeownership remains cheaper than renting with a traditional 30-year fixed rate mortgage in the 100 largest metro areas in the United States. The updated numbers show that the range is an average of...

.jpg )