“Home prices will appreciate by 5.4% over the next 12 months.”

Some Highlights:

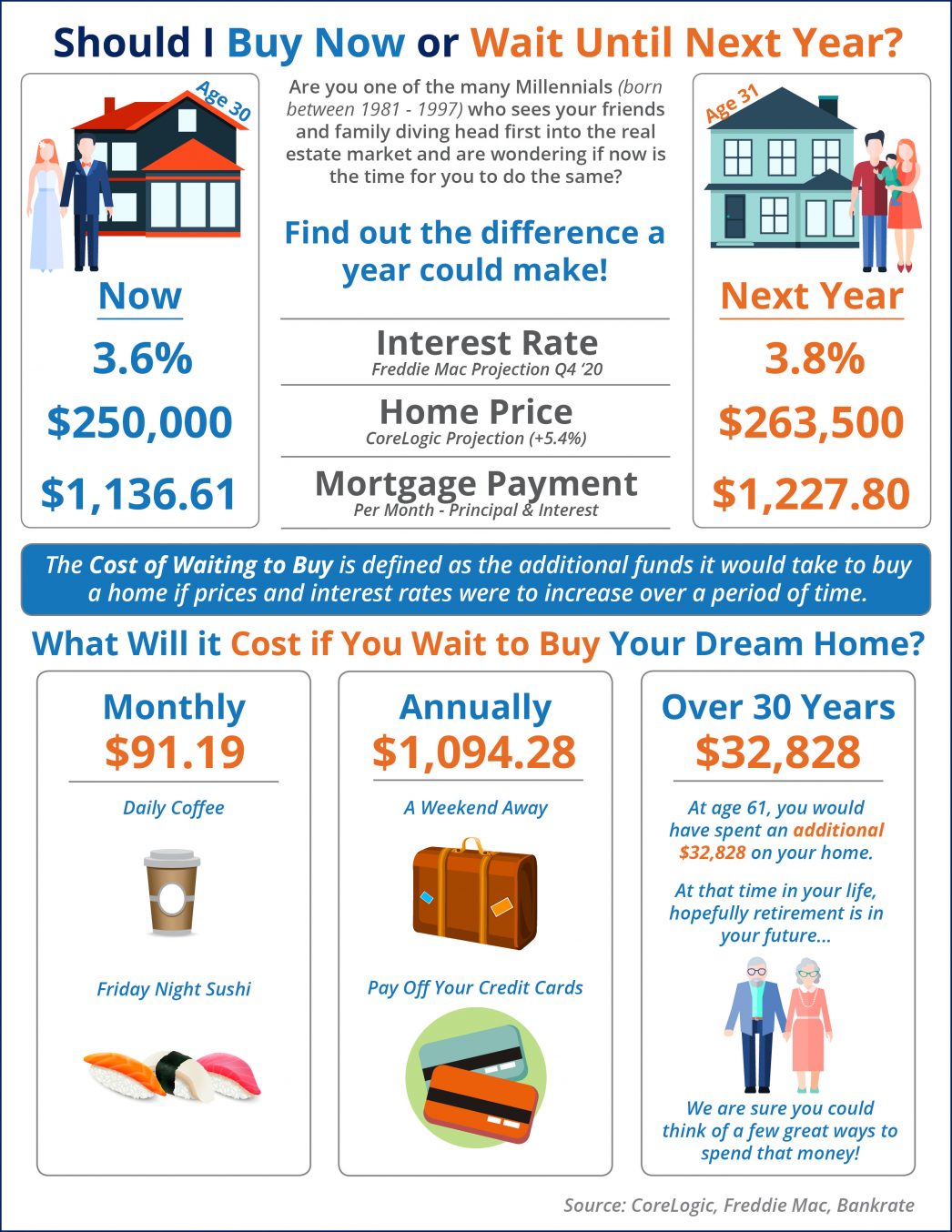

- The “cost of waiting to buy” is defined as the additional funds necessary to buy a home if prices and interest rates were to increase over a period of time.

- Freddie Mac forecasts interest rates will rise to 3.8% by Q4 2020.

- CoreLogic predicts home prices will appreciate by 5.4% over the next 12 months.

- If you’re ready and willing to buy your dream home, now is a great time to buy.

To view original article, visit Keeping Current Matters.

Gen Z: The Next Generation Is Making Moves in the Housing Market

Generation Z (Gen Z) is eager to put down their own roots and achieve financial independence. As a result, they’re turning to homeownership.

Why You Don’t Need To Fear the Return of Adjustable-Rate Mortgages

If you’re worried today’s adjustable-rate mortgages are like the ones from the housing crash, rest assured, things are different this time.

Why Median Home Sales Price Is Confusing Right Now

Median home sales prices change because there’s a mix of homes being sold is being impacted by affordability and mortgage rates.

People Want Less Expensive Homes – And Builders Are Responding

Builders producing smaller, less expensive newly built homes give you more affordable options at a time when that’s really needed.

Don’t Expect a Flood of Foreclosures

Before there can be a significant rise in foreclosures, the number of people who can’t pay their mortgage would need to rise. Since buyers are making their payments today, a wave of foreclosures isn’t likely.

Where Are People Moving Today and Why?

If you’re thinking of moving, you may be considering the inventory and affordability challenges in the housing market and how to offset these.

.jpg )