“Top reason buyers delayed their plans to move is due to high mortgage rates. Will rates change?”

If you’ve been thinking about buying a home, mortgage rates are probably top of mind for you. They may even be why you’ve put your plans on hold for now. When rates climbed near 8% last year, some buyers found the numbers just didn’t make sense for their budget anymore. That may be the case for you too.

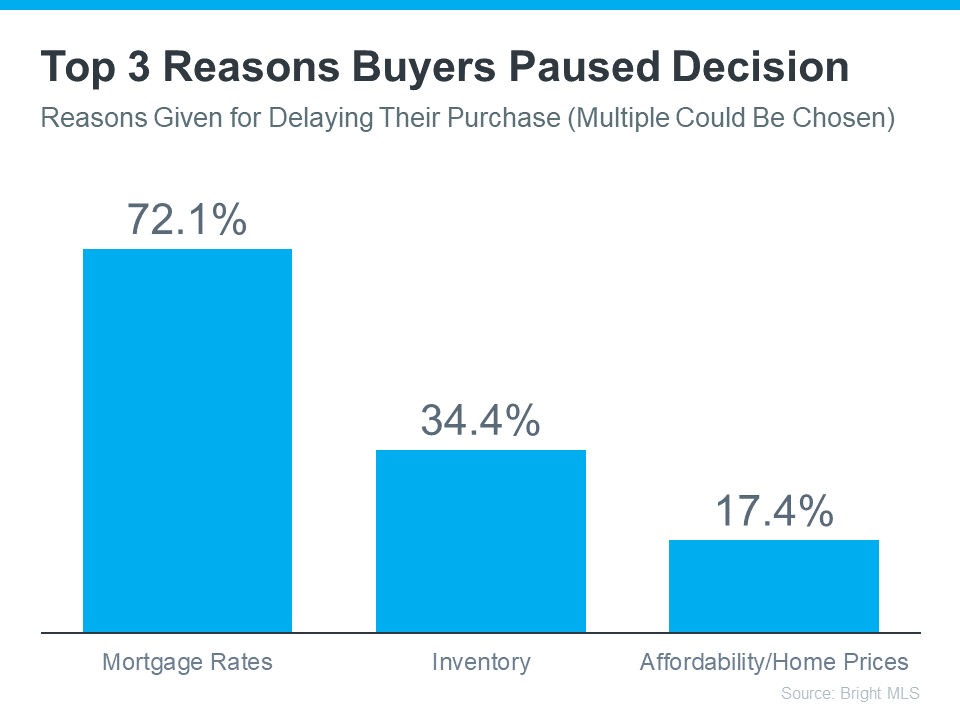

Data from Bright MLS shows the top reason buyers delayed their plans to move is due to high mortgage rates (see graph below):

David Childers, CEO at Keeping Current Matters, speaks to this statistic in the recent How’s The Market podcast:

“Three quarters of buyers said ‘we’re out’ due to mortgage rates. Here’s what I know going forward. That will change in 2024.”

That’s because mortgage rates have come down off their peak last October. And while there’s still day-to-day volatility in rates, the longer-term projections show rates should continue to drop this year, as long as inflation gets under control. Experts even say we could see rates below 6% by the end of 2024. And that threshold would be a gamechanger for a lot of buyers. As a recent article from Realtor.com says:

“Buying a home is still desired and sought after, but many people are looking for mortgage rates to come down in order to achieve it. Four out of 10 Americans looking to buy a home in the next 12 months would consider it possible if rates drop below 6%.”

While mortgage rates are nearly impossible to forecast, the optimism from the experts should give you insight into what’s ahead. If your plans were delayed, there’s light at the end of the tunnel again. That means it may be time to start thinking about your move. The best question you can ask yourself right now, is this:

What number do I want to see rates hit before I’m ready to move?

The exact percentage where you feel comfortable kicking off your search again is personal. Maybe it’s 6.5%. Maybe it’s 6.25%. Or maybe it’s once they drop below 6%.

Once you have that number in mind, here’s what you do. Connect with a local real estate professional. They’ll help you stay informed on what’s happening. And when rates hit your target, they’ll be the first to let you know.

Bottom Line

If you’ve put your plans to move on hold because of where mortgage rates are, think about the number you want to see rates hit that would make you ready to re-enter the market.

Once you have that number in mind, let’s connect so you have someone on your side to let you know when we get there.

To view original article, visit Keeping Current Matters.

What Experts Project for Home Prices Over the Next 5 Years

Once you buy a home, price appreciation raises your home’s value, and that grows your household wealth.

Planning to Retire? Your Equity Can Help You Make a Move

Whether you’re looking to downsize, relocate to a dream destination, or move closer to friends or loved ones, equity in your home may help.

Expert Home Price Forecasts Revised Up for 2023

As activity slows again at the end of the year, home price growth will slow too. This doesn’t mean prices are falling.

Buyer Traffic Is Still Stronger than the Norm

Buyers will always need to buy, and those who can afford to move at today’s rates are going to do so.

Why You May Still Want To Sell Your House After All

If you need to sell now because something in your own life has changed, don’t let mortgage rates hold you back from what you want.

Gen Z: The Next Generation Is Making Moves in the Housing Market

Generation Z (Gen Z) is eager to put down their own roots and achieve financial independence. As a result, they’re turning to homeownership.

.jpg )