“Here’s a look at what the experts are saying and how it might impact your move.”

Curious about where the housing market is headed in 2025? The good news is that experts are offering some promising forecasts, especially when it comes to two key factors that directly affect your decisions: mortgage rates and home prices.

Whether you’re thinking of buying or selling, here’s a look at what the experts are saying and how it might impact your move.

Mortgage Rates Are Forecast To Come Down

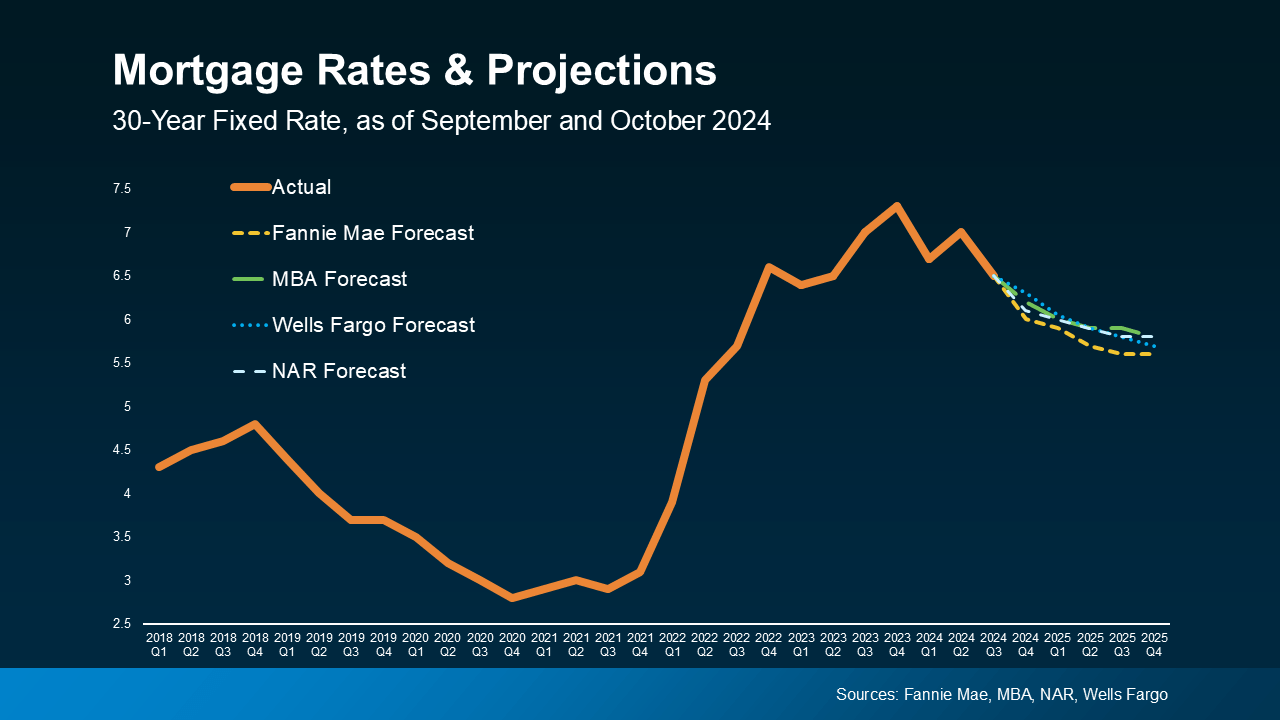

One of the biggest factors likely affecting your plans is mortgage rates, and the forecast looks positive. After rising dramatically in recent years, experts project rates will ease slightly throughout the course of 2025 (see graph below):

While that decline won’t be a straight line down, the overall trend should continue over the next year. Expect a few bumps along the way, because the trajectory of rates will depend on new economic data and inflation numbers as they’re released. But don’t get too hung up on those blips and reactions from the market as they happen. Focus on the bigger picture.

While that decline won’t be a straight line down, the overall trend should continue over the next year. Expect a few bumps along the way, because the trajectory of rates will depend on new economic data and inflation numbers as they’re released. But don’t get too hung up on those blips and reactions from the market as they happen. Focus on the bigger picture.

Lower mortgage rates mean improving affordability. As rates come down, your monthly mortgage payment decreases, giving you more flexibility in what you can afford if you buy a home.

This shift will likely bring more buyers and sellers back into the market, though. As Charlie Dougherty, Director and Senior Economist at Wells Fargo, explains:

“Lower financing costs will likely boost demand by pulling affordability-crunched buyers off of the sidelines.”

As that happens, both inventory and competition among buyers will ramp back up. The takeaway? You can get ahead of that competition now. Lean on your agent to make sure you understand how the shifts in rates are impacting demand in your area.

Home Price Projections Show Modest Growth

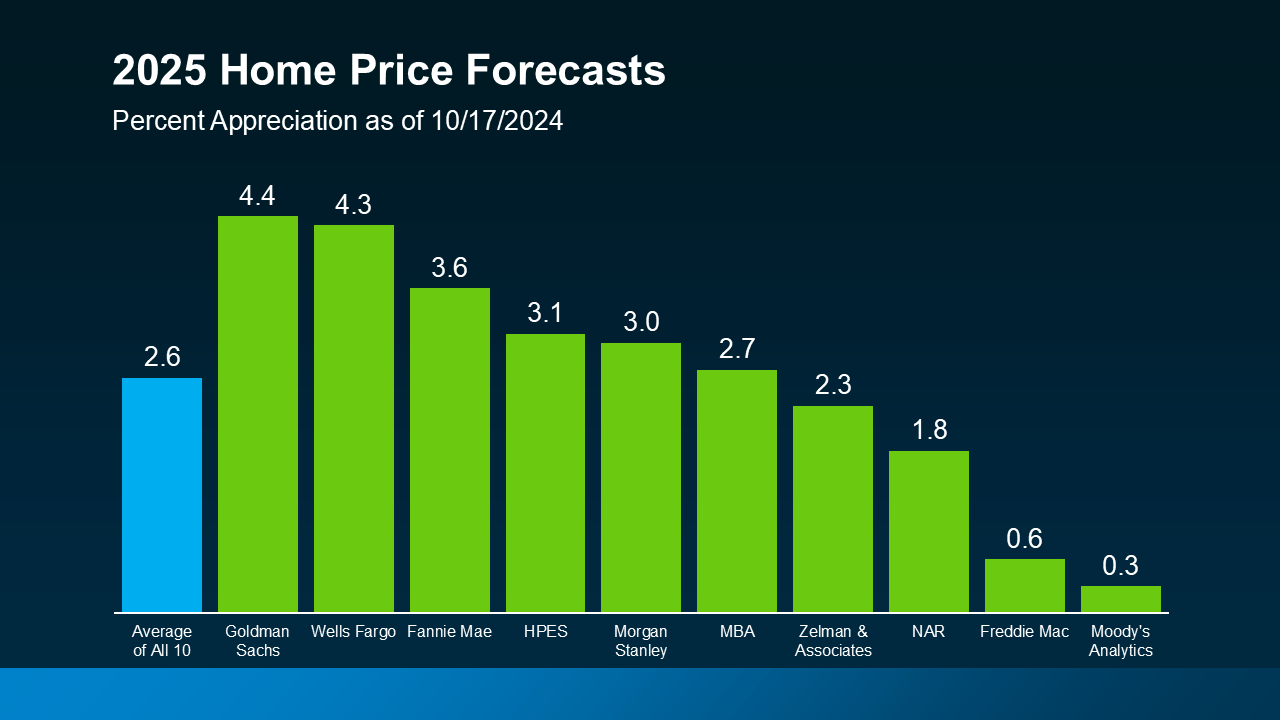

While mortgage rates are expected to come down slightly, home prices are forecast to rise—but at a much more moderate pace than the market has seen in recent years.

Experts are saying home prices will grow by an average of about 2.5% nationally in 2025 (see graph below):

This is far more manageable than the rapid price increases of previous years, which saw double-digit percentage growth in some markets.

This is far more manageable than the rapid price increases of previous years, which saw double-digit percentage growth in some markets.

What’s behind this ongoing increase in prices? Again, it has to do with demand. As more buyers return to the market, demand will rise – but so will supply as sellers feel less rate-locked.

More buyers in markets with inventory that’s still below the norm will put upward pressure on prices. But with more homes likely to be listed, supply will help keep price growth in check. This means that while prices will rise, they’ll do so at a healthier, more sustainable pace.

Of course, these national trends may not reflect exactly what’s happening in your local market. Some areas might see faster price growth, while others could see slower gains. As Lance Lambert, Co-Founder of ResiClub, says:

“Even if the average national home price forecast for 2025 is correct, it’s possible that some regional housing markets could see mild home price declines, while some markets could still see elevated appreciation. That has been, after all, the case this year.”

Even the few markets that may see flat or slightly lower prices in 2025 have had so much appreciation in recent years – it may not have a big impact. That’s why it’s important to work with a local real estate expert who can give you a clear picture of what’s happening where you’re looking to buy or sell.

Bottom Line

With mortgage rates expected to ease and home prices projected to rise at a more moderate pace, 2025 is shaping up to be a more promising year for both buyers and sellers.

If you have any questions about how these trends might impact your plans, let’s connect. That way you’ve got someone to help you navigate the market and make the most of the opportunities ahead.

To view original article, visit Keeping Current Matters.

The Cost of NOT Owning Your Home

Owning a home has great financial benefits, yet many continue to rent! Today, let’s look at the financial reasons why owning a home of your own has been a part of the American Dream for as long as America has existed.

Low Interest Rates Have a High Impact on Your Purchasing Power

According to Freddie Mac’s latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 3.92%, which is still near record lows in comparison to recent history!

5 Reasons Homeownership Makes ‘Cents’

The American Dream of homeownership is alive and well. Recent reports show that the US homeownership rate has rebounded from recent lows and is headed in the right direction. The personal reasons to own differ for each buyer, but there are many basic similarities.

A Housing Bubble? Industry Experts Say NO!

With residential home prices continuing to appreciate at levels above historic norms, some are questioning if we are heading toward another housing bubble. Recently, five housing experts weighed in on the question.

How to Save on a Mortgage Payment Whether Buying or Selling

In Trulia’s recent report, Rent vs. Buy: Roommate Edition, they examined the impact that renting with a roommate has in determining whether it is more expensive to rent or buy. The study explains: “Since we started keeping track in 2012, it’s been a better deal to buy...

The #1 Reason to List Your House, NOW!

The inventory of homes for sale has fallen year-over-year for the last 28 months and has had an upward impact on home prices.

.jpg )