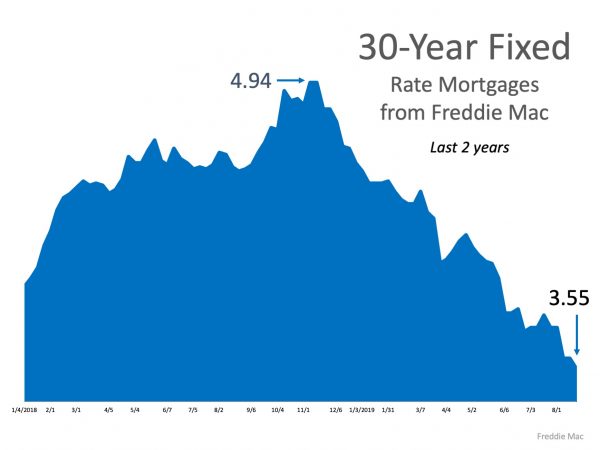

“Mortgage rates have fallen by over a full percentage point since Q4 of 2018, settling at near-historic lows.”

Mortgage rates have fallen by over a full percentage point since Q4 of 2018, settling at near-historic lows. This is big news for buyers looking to get more for their money in the current housing market. According to Freddie Mac’s Primary Mortgage Market Survey,

According to Freddie Mac’s Primary Mortgage Market Survey,

“the 30-year fixed-rate mortgage (FRM) rate averaged 3.60 percent, the lowest it has been since November 2016.”

Sam Khater, Chief Economist at Freddie Mac, notes how this is great news for homebuyers. He states,

“…consumer sentiment remains buoyed by a strong labor market and low rates that will continue to drive home sales into the fall.”

As a potential buyer, the best thing you can do is work with a trusted advisor who can help you keep a close eye on how the market is changing. Relying on current expert advice is more important than ever when it comes to making a confident and informed decision for you and your family.

Bottom Line

Even a small increase (or decrease) in interest rates can impact your monthly housing cost. If buying a home is on your short list of goals to achieve, let’s get together to determine your best move.

To view original article, visit Keeping Current Matters.

Is It Time To Put Your House Back on the Market?

Since January, demand has picked up – and that should continue as spring draws even closer.

Should I Buy a Home Right Now? Experts Say Prices Are Only Going Up

If you’re debating whether to buy now or wait, remember: real estate rewards those in the market, not those who try to time it perfectly.

Rising Inventory Means This Spring Could Be Your Moment

If you’ve been on the sidelines, waiting for the right time to buy, this spring could be the opening you’ve been hoping for.

Is a Newly Built Home Right for You? The Pros and Cons

An agent can walk you through the pros and cons of considering a newly built home and help you decide if it makes sense for you.

Is the Housing Market Starting To Balance Out?

While it’s still a seller’s market in many places, buyers in certain locations have more leverage than they’ve had in years.

Do You Know How Much Your Home Is Worth?

The only way to get an accurate look at what your house is really worth is to talk to a local real estate agent.

.jpg )