“Let’s break it down and see why today’s mortgage debt isn’t anything to fear.”

One major reason why we’re not heading toward a foreclosure crisis is the high level of equity homeowners have today. Unlike in the last housing bubble, where many homeowners owed more than their homes were worth, today’s homeowners have far more equity than debt.

That’s a big part of the reason why even though mortgage debt is at an all-time high, this isn’t 2008 all over again. As Bill McBride, Housing Analyst for Calculated Risk, explains:

“With the recent house price increases, some people are worried about a new housing bubble – but mortgage debt isn’t a concern . . .”

Today’s homeowners are in a much stronger position than ever before. So, let’s break it down and see why today’s mortgage debt isn’t anything to fear.

More Equity, Less Risk of Foreclosures

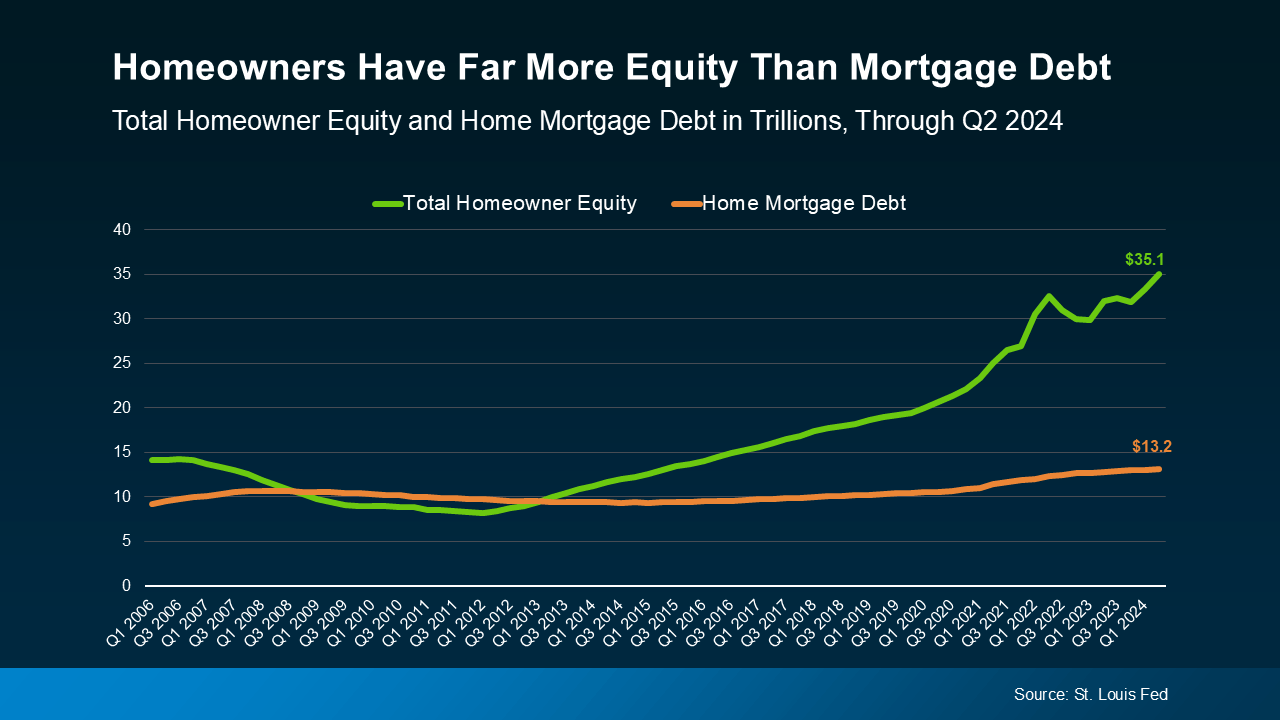

According to the St. Louis Fed, total homeowner equity is nearly triple the total mortgage debt today (see graph below):

High equity makes it less likely for homeowners to face foreclosure because they have more options. If someone struggles to make their mortgage payments, they could potentially sell their house and still come out ahead thanks to their built-up equity.

High equity makes it less likely for homeowners to face foreclosure because they have more options. If someone struggles to make their mortgage payments, they could potentially sell their house and still come out ahead thanks to their built-up equity.

Even if home values were to dip, most homeowners would still have a comfortable cushion of equity. That’s a big contrast to the 2008 crisis, where many homeowners were underwater on their mortgages and had few options to avoid foreclosure.

Delinquency Rates Are Still Near Historic Lows

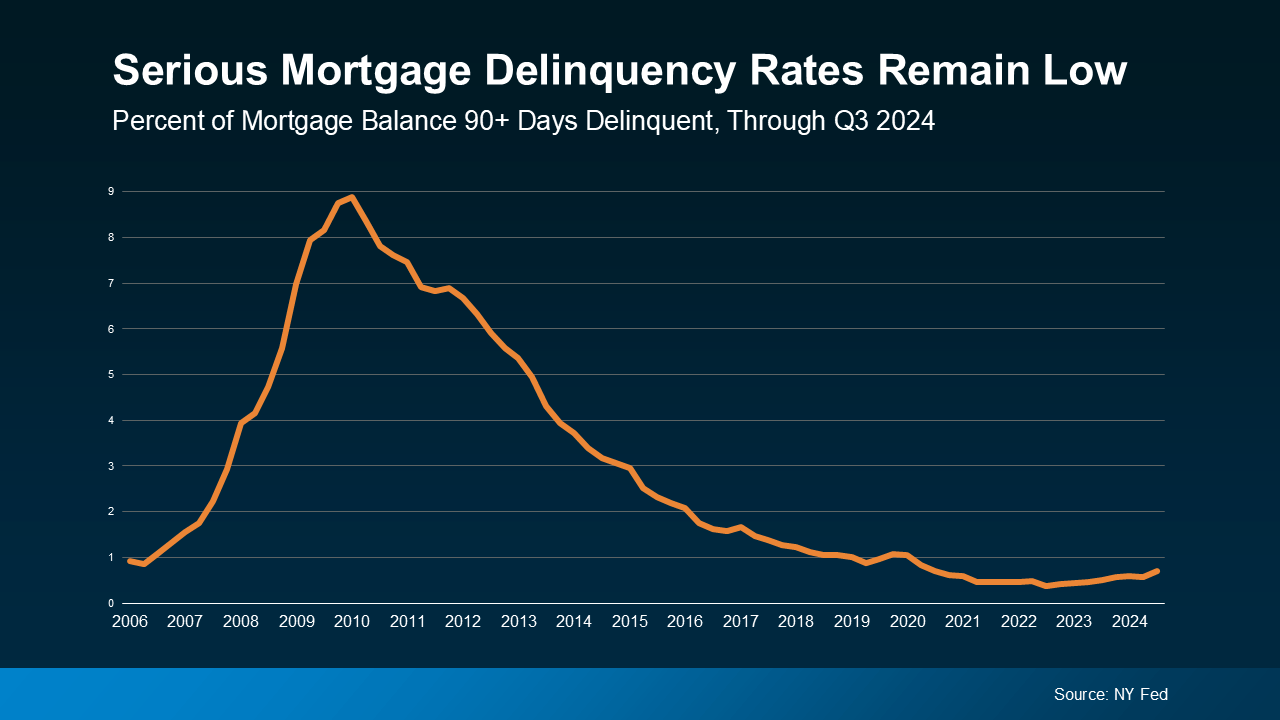

Another reassuring sign is that, according to the NY Fed, the number of mortgage payments that are more than 90 days late is still near historic lows (see graph below):

This is partly due to a variety of programs designed to help homeowners through temporary hardships. As Marina Walsh, VP of Industry Analysis at the Mortgage Bankers Association (MBA), says:

This is partly due to a variety of programs designed to help homeowners through temporary hardships. As Marina Walsh, VP of Industry Analysis at the Mortgage Bankers Association (MBA), says:

“. . . servicers are helping at-risk homeowners avoid foreclosures through loan workout options that can mitigate temporary distress.”

So, even if someone falls behind on their payments, there are support systems in place to help them avoid foreclosure.

Low Unemployment Helps Keep the Market Stable

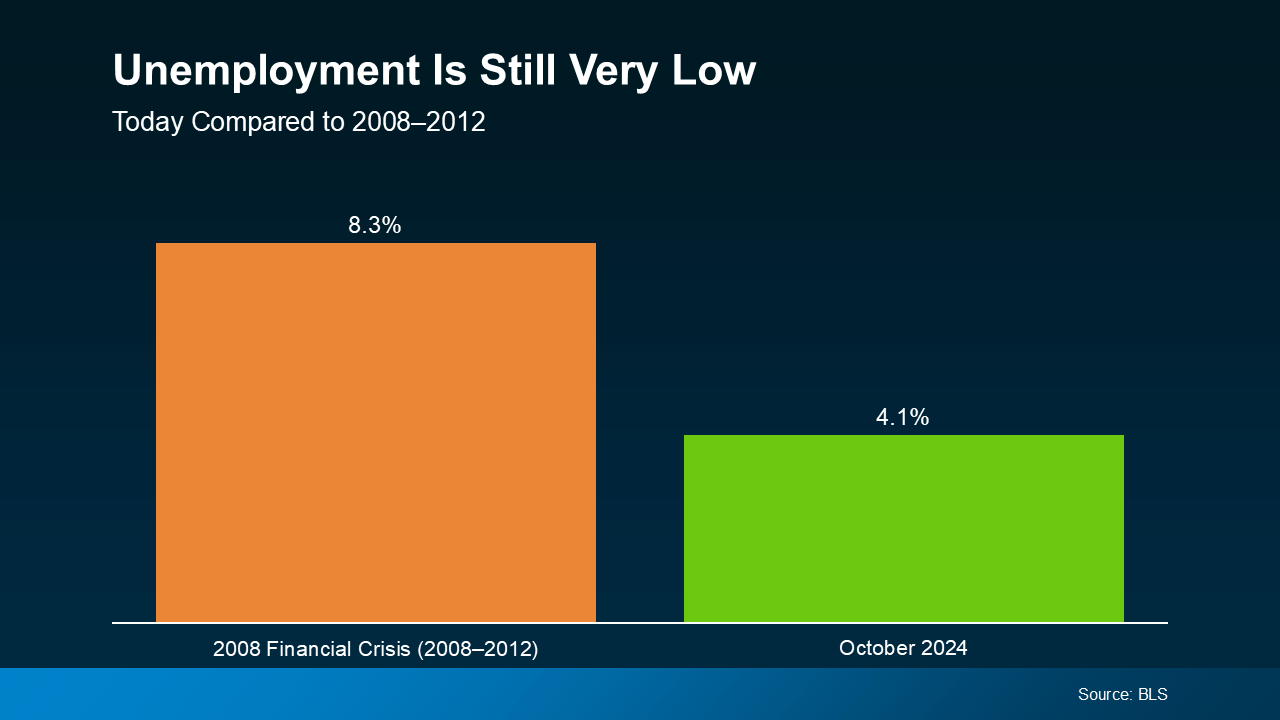

One other important factor is today’s low unemployment rate. More people have stable jobs, which means they’re better able to afford their mortgage payments. As Archana Pradhan, Principal Economist at CoreLogic, explains:

“Low unemployment numbers have helped reduce the overall delinquency rate . . .”

During the last housing crisis, unemployment was much higher, which led to a wave of foreclosures. Today’s unemployment rate is very different (see graph below):

That stability in how many people are employed is one of the reasons the market doesn’t have the same risks as it did the last time.

That stability in how many people are employed is one of the reasons the market doesn’t have the same risks as it did the last time.

There’s no need to worry about a wave of distressed sales like the one we saw in 2008. Most homeowners today are employed and have low-interest mortgages they can afford, so they’re able to make their payments. As McBride states:

“The bottom line is there will not be a huge wave of distressed sales as happened following the housing bubble.”

Bottom Line

While mortgage debt is high, rest assured the market isn’t on the brink of another crash. Instead, most homeowners are in a strong position. If you have questions or concerns, let’s connect.

To view original article, visit Keeping Current Matters.

The Top Indicator if You Want to Know Where Mortgage Rates Are Heading

Mortgage rates have increased significantly since the beginning of the year.

Owning Is More Affordable than Renting in the Majority of the Country

If you’re weighing your options between renting and buying, it’s important to look at the full picture.

Why Right Now Is a Once-in-a-Lifetime Opportunity for Sellers

In the case of homeowners who are thinking about selling, there may never be a better time than right now.

Why Pre-Approval Is Key for Homebuyers in 2022

Every step you can take to gain an advantage as a buyer is crucial when today’s market is constantly changing.

Buyers Want To Know: Why Is Housing Supply Still So Low?

While low inventory in the housing market isn’t new, it’s a challenge that continues to grow over time.

With Mortgage Rates Climbing, Now’s the Time to Act

Historical data shows that today’s rate, even at 3.45%, is still well below the average for each of the last five decades.

.jpg )