“Even though there are more homes for sale this year, there are still more buyers than houses.”

Even though there are more homes available for sale than there were at this time last year, there are still more buyers than there are houses to choose from. So, know that if you’ve got moving on your mind, your house can really stand out.

There are several key reasons why there aren’t enough homes to go around and understanding them will help you see why the market is working in your favor if you’re ready to make a move.

What’s Causing the Shortage?

1. Underproduction of Homes: For years, the industry hasn’t built enough homes to keep up with demand. As Zillow explains:

“In 2022, 1.4 million homes were built — at the time, the best year for home construction since the early stages of the Great Recession. However, the number of U.S. families increased by 1.8 million that year, meaning the country did not even build enough to make a place for the new families, let alone begin chipping away at the deficit that has hampered housing affordability for more than a decade.”

2. Rising Costs: Building materials, labor shortages, and supply chain disruptions caused by the pandemic have all made it harder and more expensive to build homes. This can either limit or stop new home construction in some areas.

3. Regional Imbalances: Some markets are more affected by the shortage of homes than others. Popular and more desirable areas have more people moving in faster than new homes can be built. The number of new building permits issued doesn’t always keep pace with job growth in these regions, and that leads to even tighter markets and higher prices.

How Big Is the Problem?

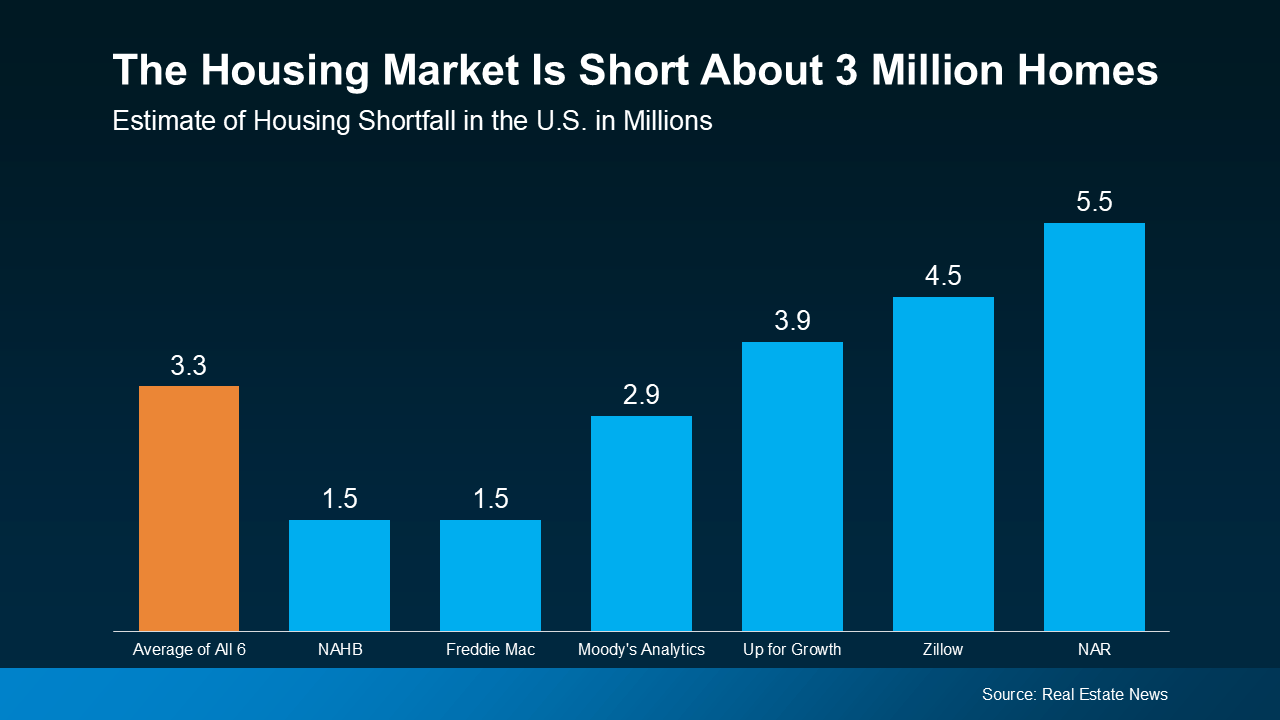

According to estimates from Real Estate News, the U.S. is facing a housing shortfall of roughly 3.3 million homes, based on an average of several expert insights (see graph below):

This shows there’s a significant number of homes that need to be built just to meet current demand from buyers. But what about future demand?

This shows there’s a significant number of homes that need to be built just to meet current demand from buyers. But what about future demand?

According to John Burns Research and Consulting (JBREC), over the next 10 years, the U.S. will need about 18 million new homes to meet projected demand, including homes for new households, second homes, and replacements for aging or unusable homes.

So, even though more homes are on the market compared to last year, there still aren’t enough of them to go around. This is where you can really win if you’re ready to sell your house.

What You Need To Remember

If you’re thinking about selling, the shortage of homes for sale means your house is likely to get some serious attention from buyers. It’ll take years to climb out of this inventory deficit, and the market is still very tight. So, when buyers are competing for relatively few homes like they are right now, that creates more interest in the houses that are on the market, putting upward pressure on prices and ultimately working in your favor.

And since every market is different, it’s important to work with a real estate agent who understands local trends. They can help you price your house right and create a strategy to attract the right buyers.

Bottom Line

While there are more homes for sale than there were at this time last year, there’s still a shortage overall. And this puts you in the driver’s seat as a seller. Let’s connect so you have someone who can help you take advantage of today’s market.

To view original article, visit Keeping Current Matters.

December 2019: The Buyer Stakes Are High Because Inventory Is Low

If you’re a buyer, be sure to get pre-approved for a mortgage and be ready to make a competitive offer, so you can move quickly.

Get Your House Ready to Sell This Winter

According to realtor.com, “there are a few small repairs that will make your home sell faster and for more money. Get your house ready to sell now with quick and easy fixes that make a big impact!”

Holiday Gifts Are Not the Only Hot Things Right Now

If you’re thinking of selling your house in 2020, you don’t need to wait until the spring to do it. There are active buyers looking right now!

Have You Outgrown Your Home?

It may seem hard to imagine that the home you’re in today – whether it’s your starter home or just one you’ve fallen in love with along the way – might not be your forever home.

A 365 Day Difference in Homeownership

Over the past year, mortgage rates have fallen more than a full percentage point. This is a great driver for homeownership, as today’s low rates provide consumers with some significant benefits.

Have You Budgeted for Closing Costs?

Closing costs are typically between 2% and 5% of your purchase price. Have you planned for this expense? Our agents are here to help you with all your real estate needs!

.jpg )