“If home price gains are about to re-accelerate, buying now rather than later makes financial sense.”

1. Affordability

Many people focus solely on price when talking about home affordability. Since home prices have appreciated throughout the past year, they assume homes are less affordable. However, affordability is determined by three components:

- Price

- Wages

- Mortgage Interest Rate

Prices are up, but so are wages – and interest rates have recently dropped dramatically (see #2 below). As a result, the National Association of Realtors’ (NAR) latest Affordability Index report revealed that homes are MORE affordable throughout the country today than they were a year ago.

“All four regions saw an increase in affordability from a year ago. The South had the biggest gain in affordability of 6.9%, followed by the West with a gain of 6.0%. The Midwest had an increase of 5.8%, followed by the Northeast with the smallest gain of 1.8%.”

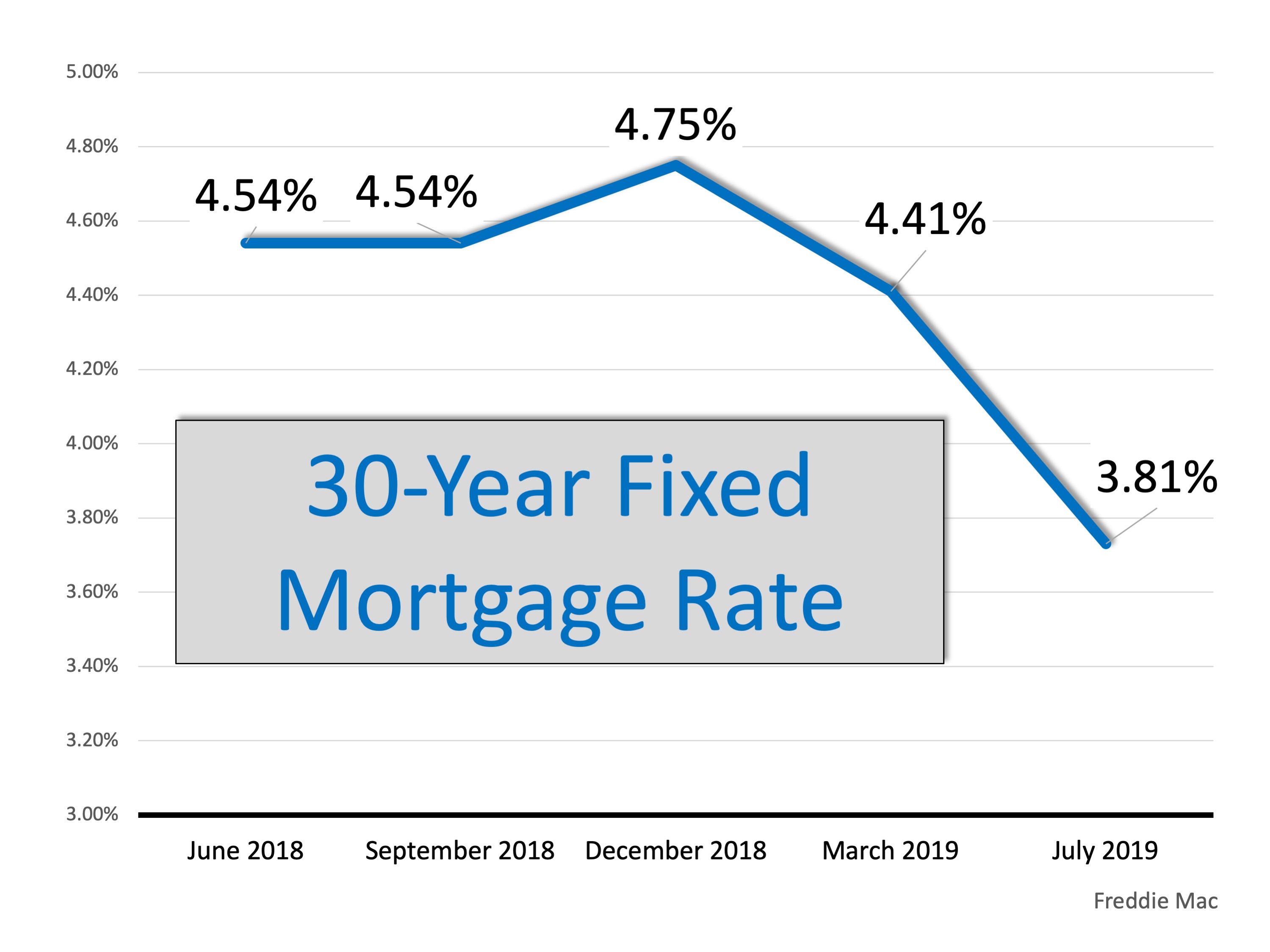

2. Mortgage Interest Rates

Mortgage rates have dropped almost a full point after heading toward 5% last fall and early winter. Currently, they are below 4%. Additionally, Fannie Mae recently predicted the average rate for a 30-year fixed mortgage will be 3.7% in the second half of 2019. That compares to a 4.4% average rate in the first quarter and 4% in the second quarter.

Additionally, Fannie Mae recently predicted the average rate for a 30-year fixed mortgage will be 3.7% in the second half of 2019. That compares to a 4.4% average rate in the first quarter and 4% in the second quarter.

With mortgage rates remaining near historic lows, Fannie Mae and others have increased their forecasts for housing appreciation for the rest of the year. If home price gains are about to re-accelerate, buying now rather than later makes financial sense.

3. Increase Family Wealth

Homeownership has always been recognized as a sensational way to build long-term family wealth. A new report by ATTOM Data Solutions reveals:

“U.S. homeowners who sold in the second quarter of 2019 realized an average home price gain since purchase of $67,500, up from an average gain of $57,706 in Q1 2019 and up from an average gain of $60,100 in Q2 2018. The average home seller gain of $67,500 in Q2 2019 represented an average 33.9 percent return as a percentage of original purchase price.”

The longer you delay purchasing a home, the longer you are waiting to put the power of home equity to work for you.

Bottom Line

With affordability increasing, mortgage rates decreasing, and home values about to re-accelerate, it may be time to make a move. Let’s get together to determine if buying now makes sense for your family.

To view original article, visit Keeping Current Matters.

What’s Ahead for Home Prices in 2023

The decision to purchase a home is best made when you do it knowing all the facts and have an expert on your side. Call today to speak to one of our expert real estate agents.

What Buyer Activity Tells Us About the Housing Market

January’s home showings are a positive sign that buyers are getting back out there.

An Expert Gives You Clarity in Today’s Housing Market

The right agent can help you understand what’s happening at the national and local levels.

Leverage Your Equity When You Sell Your House

Record levels of home equity provide security for millions of families, and minimize the chance of another housing market crash.

4 Tips for Making Your Best Offer on a Home

When putting together an offer, your trusted real estate advisor will help you think through what levers to pull.

Could a Multigenerational Home Be the Right Fit for You?

Multi-generational home buying is a way for families to often buy a home that may have been previously out of reach.

.jpg )