“If negative news coverage has made you question if you should delay your plans to move, here’s what you really need to know.”

During the fourth quarter of last year, some housing experts projected home prices were going to crash in 2023. The media ran with those forecasts and put out headlines calling for doom and gloom in the housing market. All of this negative news coverage made a lot of people have doubts about the strength of the residential real estate market.

If it made you question if you should delay your own plans to move, here’s what you really need to know.

Home Prices Never Crashed

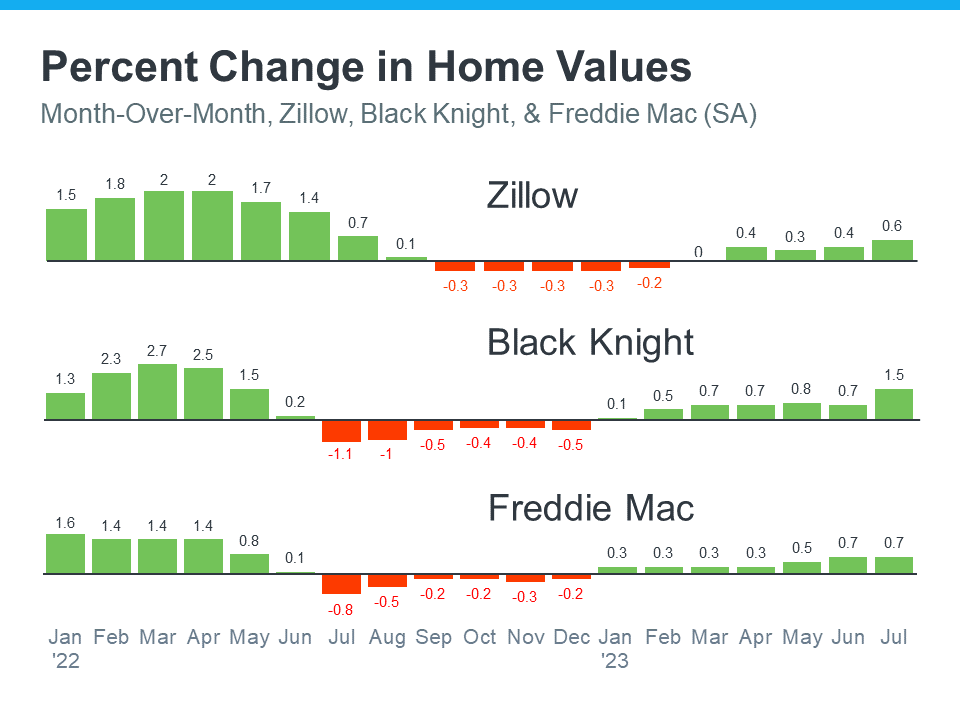

Disregard what you saw in the headlines. The actual data shows home prices were remarkably resilient and performed far better than the media would have you believe (see graph below):

This graph uses reports from three trusted sources to clearly illustrate prices have already rebounded after experiencing only slight declines nationally. That’s a far cry from the crash so many articles called for.

The declines that did happen (shown in red), weren’t drastic but were short-lived. As Nicole Friedman, a reporter at the Wall Street Journal (WSJ), says:

“Home prices aren’t falling anymore. . . The surprisingly quick recovery suggests that the residential real-estate downturn is turning out to be shorter and shallower than many housing economists expected . . .”

Even though some media coverage made a big deal about home prices pulling back, the slight correction that happened is already in the rearview mirror. Basically, this data shows you home prices aren’t falling anymore – they’re actually going back up.

What’s Next for Home Prices?

The consensus from experts is that home price growth will continue in the years ahead and is returning to normal levels for the market. That means we’ll still see home prices appreciating, just at a slower pace than the last few years – and that’s a good thing.

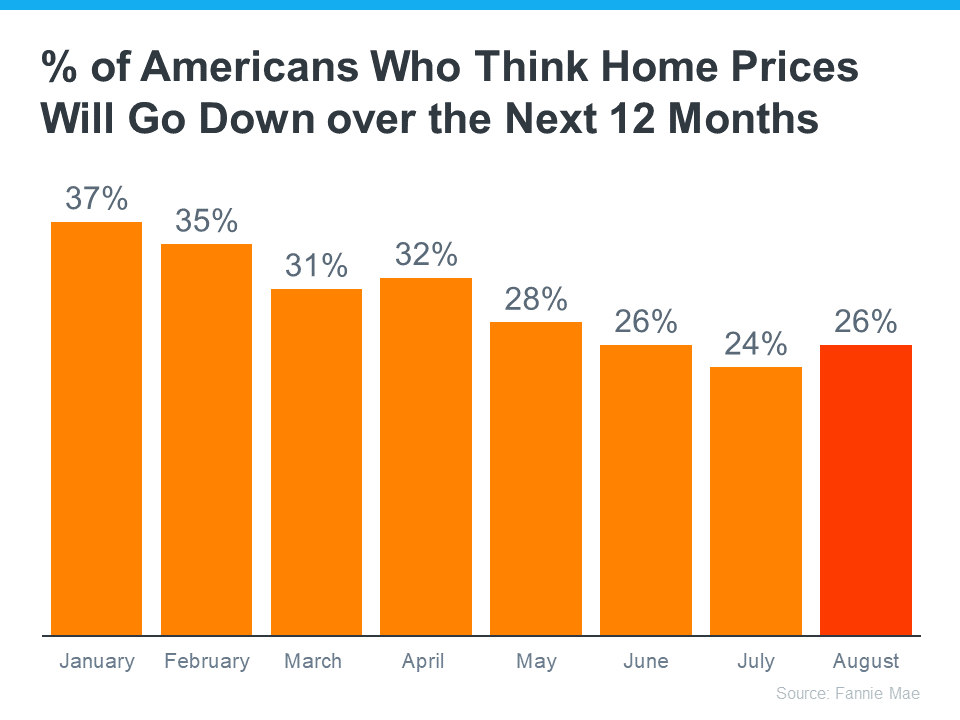

Some news sources will see home price growth slowing and put out stories that make you think prices are falling again. The return of misleading headlines like those is already having an impact on how homebuyers are feeling again. You can see how this affects general opinion in the Consumer Confidence Survey from Fannie Mae (see graph below):

While the percentage of Americans who think prices will fall has been slowly declining this year, the latest Consumer Confidence data indicates that’s ticked back up recently (shown in red). This change is surprising especially since the home price data shows prices are going up, not down. It tells you the impact the media still has on public opinion.

Don’t fall for the negative headlines and become part of this statistic. Remember, data from a number of sources shows home prices aren’t falling anymore.

Bottom Line

Even though the media may make things sound doom and gloom, the data shows home prices aren’t falling anymore. So, don’t let the headlines scare you or delay your plans. Let’s connect so you have a trusted resource to cut through the noise and tell you what’s really happening in our area.

To view original article, visit Keeping Current Matters.

Are Home Prices Going Up or Down? That Depends…

We’re about to enter a few months when home prices could possibly be lower than they were the same month last year.

This Real Estate Market Is the Strongest of Our Lifetime

This is one of the most foundationally strong housing markets of our lifetime – if not the strongest housing market of our lifetime.

Real Estate Is Still Considered the Best Long-Term Investment

Real estate was voted the best long-term investment for the 11th consecutive year, beating gold, stocks, and bonds.

Oops! Home Prices Didn’t Crash After All

Home prices didn’t come crashing down and may already rebounding from the minimal depreciation experienced over the last few months.

Keys to Success for First-Time Homebuyers

The best way to make sure you’re set up for success, especially if you’re just starting out, is to work with a trusted real estate agent.

Today’s Real Estate Market: The ‘Unicorns’ Have Galloped Off

The pandemic profoundly changed real estate over the last few years. The demand for a home of our own skyrocketed, and needs changed.

.jpg )