“Nationally, demand is still high compared to the last normal years in the housing market and plenty of buyers are making moves right now.”

If you were worried buyer demand disappeared when mortgage rates went up, the data shows there are plenty of interested buyers still out there. The housing market isn’t as frenzied as it was during the ‘unicorn’ years when buyer demand was through the roof, mortgage rates were historically low, and home values rose like we’ve never seen before. But that doesn’t mean the market is at a standstill.

Nationally, demand is still high compared to the last normal years in the housing market and plenty of buyers are making moves right now. Here’s the data to prove it.

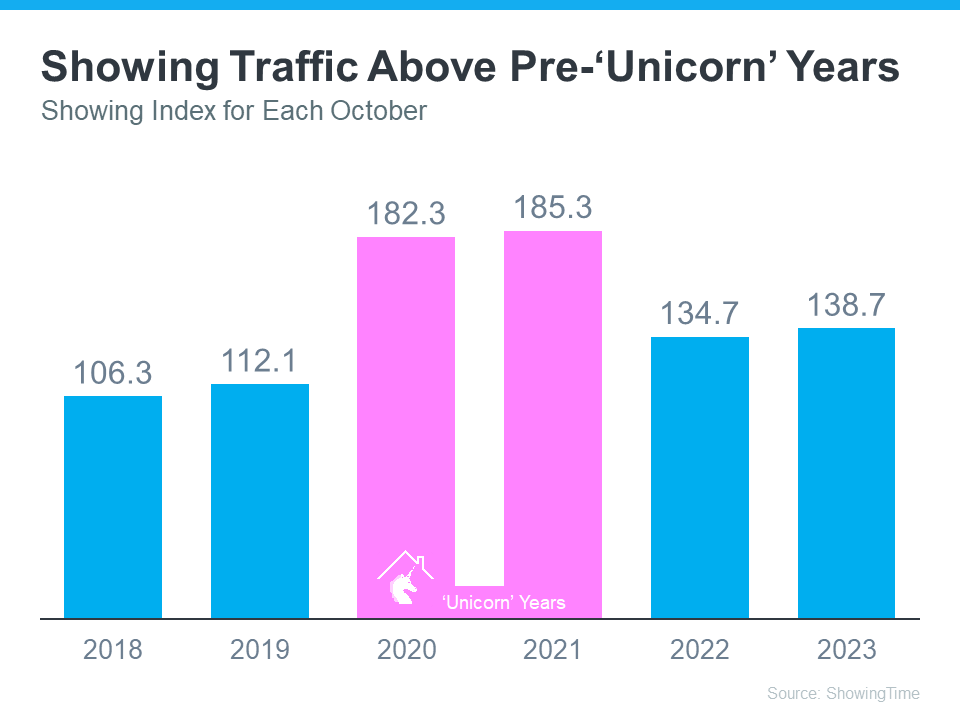

Showing Traffic Is Up

The ShowingTime Showing Index is a measure of how frequently buyers are touring homes. The graph below uses that index to show buyer activity over the past eight Octobers:

In the graph, the ‘unicorn’ years are shown in pink. You can see demand has dipped some since then. That’s in response to higher mortgage rates. But, when you compare 2023 to the blue bars on the left that represent the last normal years in the market (2018-2019), you can tell buyers are still more active than the norm.

But showing traffic isn’t the only way to see buyer demand is still high. The number of offers other sellers are getting and the average days homes are on the market tell the same story.

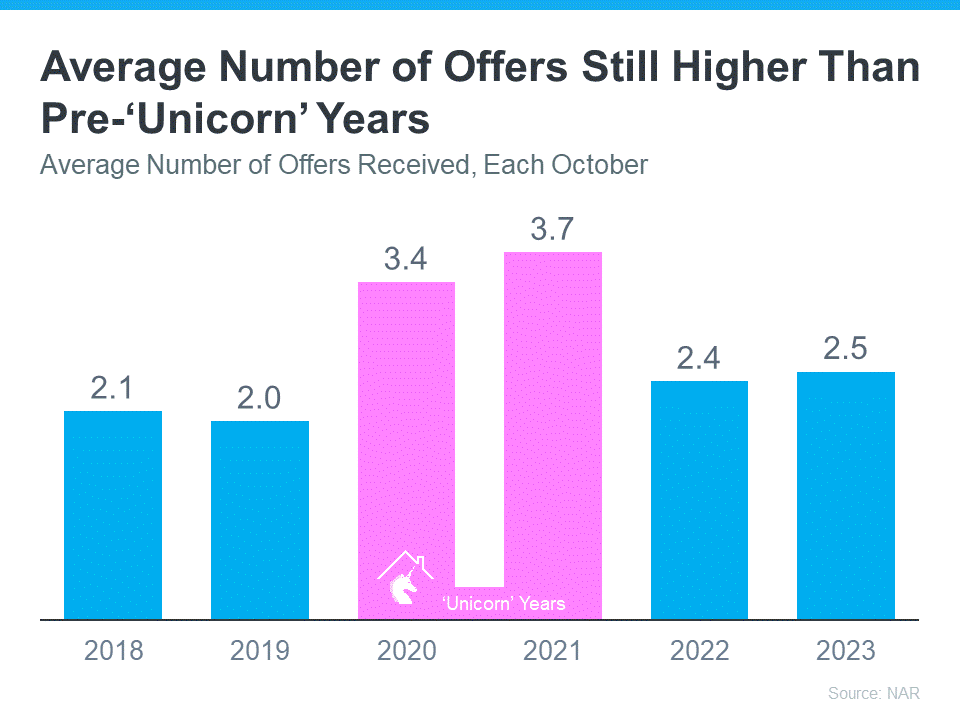

Sellers Are Still Seeing Multiple Offers

According to the latest data from the National Association of Realtors (NAR), sellers are receiving an average of 2.5 offers on their houses. Let’s look at how that compares to recent years (see graph below):

It’s true that’s fewer than the number of offers sellers were receiving during the ‘unicorn’ years (shown in pink). But compared to last year, the number is up slightly. And it’s higher than it was in the more normal, pre-‘unicorn’ years in the housing market too.

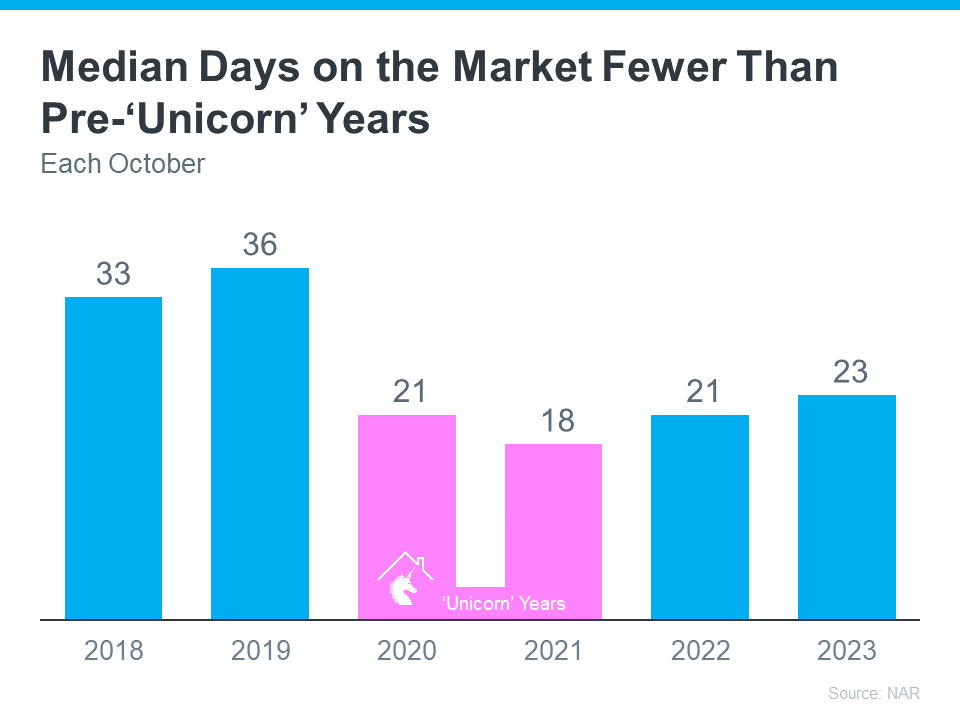

Homes Priced Right Are Selling Fast

And it’s not just that sellers are still typically getting multiple offers more than the norm, they’re also seeing their homes sell fast. That’s a direct result of strong buyer demand. According to Zillow:

“. . . low inventory levels are spurring surprisingly strong competition . . . demand has remained resilient, and attractive, appropriately priced listings are moving quickly.”

To help showcase that homes for sale are still going quickly, let’s look at data from NAR on the median days on market for this same time of year from 2018 through now (see graph below):

As the graph shows, this year homes are sitting on the market only slightly longer than they were during the frenzy of the ‘unicorn’ years. And compared to the last normal years in the market, homes are still selling much faster than they did back then. That’s good news for sellers because it means there are eager buyers out there right now.

Bottom Line

You haven’t missed your chance to sell at a time when sellers are receiving multiple offers, and homes are selling fast. When you’re ready to sell your house, let’s connect to get the ball rolling.

To view original article, visit Keeping Current Matters.

Should I Refinance My Home?

With recent lower interest rates, many homeowners are wondering if they should refinance their home. Are you? Start by asking yourself these 3 questions.

Home Price Appreciation Forecast

Questions continue to come up about where home prices will head throughout the rest of this year. We have projections from the industry’s leading experts!!

How Long Until Sellers Seriously Consider a Price Cut?

A lingering listing with no takers … how long does it take until the home seller is willing to accept that a price reduction is needed?

Just Listed! 1 Newpoint Lane, East Moriches

Spacious 4 bedroom, 2.5 bath colonial in Newport Beach with deeded beach and boating rights! Call us today to schedule a showing!

How to Know if a Home Buyer is Serious

Not sure how to tell if a homebuyer is serious about purchasing your home? Fortunately, there are usually quite a few clues that can help you gauge a home buyer’s interest and intent.

Is Your First Home Now Within Your Grasp?

For the longest time, many experts doubted whether Millennials (ages 18-36) valued homeownership as part of their American Dream.

.jpg )