“Roughly one in six Americans take care of their children and their parents or grandparents at the same time.”

Are you a part of the Sandwich Generation? According to Realtor.com, that’s a name for the roughly one in six Americans who take care of their children and their parents or grandparents at the same time.

If that sounds familiar to you, juggling all the responsibilities involved certainly must have its challenges. But it turns out there’s one pretty significant benefit: it can actually make it a bit easier for you to buy a home.

How Can It Help You Buy a Home?

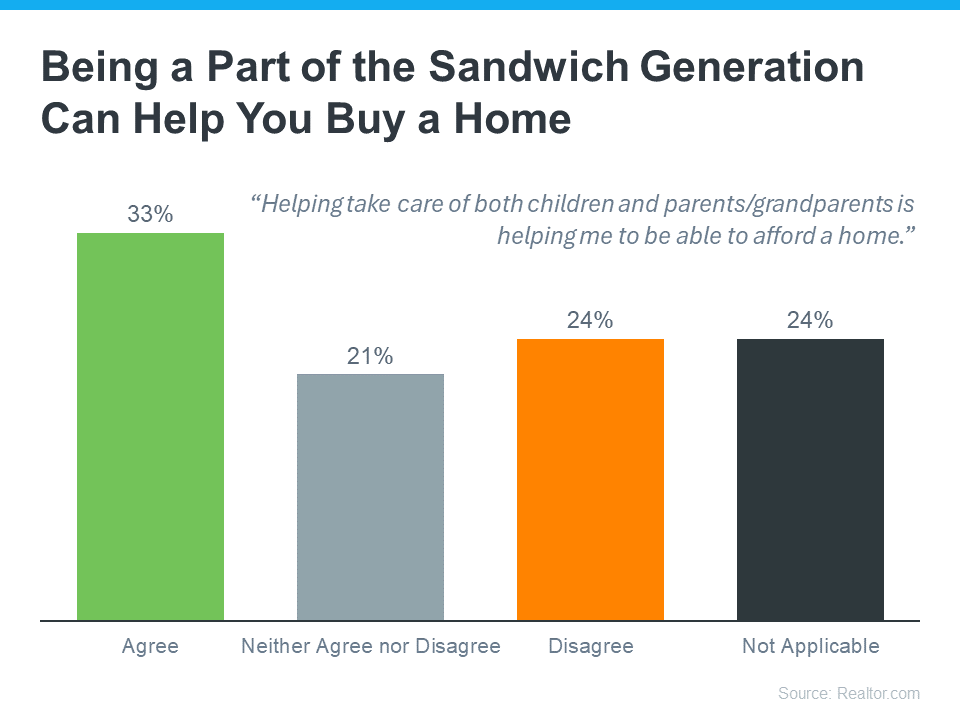

Realtor.com asked members of the Sandwich Generation if they agree or disagree that taking care of children and parents at the same time is helping them afford a home. A third of respondents said their situation made it easier to buy (see graph below):

Here are a few ways their caretaking situation might be helping those 33% buy a home:

Here are a few ways their caretaking situation might be helping those 33% buy a home:

- Sharing Expenses: If you live in a multi-generational household, you can pool your resources and split the costs. Your parents might contribute to the mortgage or help with other bills. This can make a big difference, especially in today’s housing market. It may help you afford a larger home than you could on your own.

- Built-In Childcare: Having grandparents in the home could also save you money on childcare. They can help watch your kids while you’re at work, which means you can save on daycare costs too.

Beyond just the financial reasons, buying a multi-generational home has other advantages. The Profile of Home Buyers and Sellers from the National Association of Realtors (NAR) highlights some of the most popular, including:

- Easier To Care for Aging Parents: It’s more convenient to take care of someone when you live with them. Also, your elderly parents may very well be happier and healthier, thanks to more social interaction and a feeling of connectedness.

- Spending More Time Together: Once you live together, you get to spend more time and create even more lasting memories with your loved ones.

The Mortgage Reports sums it up this way:

“Buying a house with your parents can be a great way to ease caregiving, support young children, or simply bring loved ones closer together. And considering the steep rise in home prices over the last few years, it can make homeownership a lot more affordable.”

How a Real Estate Agent Can Help

If you’re in the Sandwich Generation and thinking about buying a multi-generational home, working with a local real estate agent is essential. Finding a home that works for so many people can be tricky. An agent will use their expertise to help you find one that meets the needs of, and has enough space for, everyone who’s going to live there.

Bottom Line

Being a part of the Sandwich Generation comes with its challenges – but it also might come with one truly great perk. If you’re looking to buy a home, your caregiving situation can actually make it a bit easier for you to afford a home. To learn more, let’s connect.

To view original article, visit Keeping Current Matters.

What’s Ahead for Home Prices in 2023

The decision to purchase a home is best made when you do it knowing all the facts and have an expert on your side. Call today to speak to one of our expert real estate agents.

What Buyer Activity Tells Us About the Housing Market

January’s home showings are a positive sign that buyers are getting back out there.

An Expert Gives You Clarity in Today’s Housing Market

The right agent can help you understand what’s happening at the national and local levels.

Leverage Your Equity When You Sell Your House

Record levels of home equity provide security for millions of families, and minimize the chance of another housing market crash.

4 Tips for Making Your Best Offer on a Home

When putting together an offer, your trusted real estate advisor will help you think through what levers to pull.

Could a Multigenerational Home Be the Right Fit for You?

Multi-generational home buying is a way for families to often buy a home that may have been previously out of reach.

.jpg )